Every year, CE Pro selects five trends that could have a major impact on home technology, especially as it relates to the integrator channel.

Everything's fair game, from audio, video and home automation technologies, to macroeconomic trends, to shifts in consumer behavior.

This year, our 5 Top Home Tech Trends of 2017 are:

- Voice Control Integration

- Virtual Reality and Augmented Reality

- Device Discovery and Data Collection

- New Models in Tech Deployment

- Fiber in the Home

1. Voice Control Integration | julie jacobson

Voice Control Tidbits

-

Amazon popularized voice control for the home with Echo, but in 2017 we can expect hundreds or thousands of smart devices with native Alexa Video Services, no Echo required.

-

Google Home and the Google Assistant speech-recognition platform has the potential to dominate the category with its robust ecosystem that now includes the Pixel phone. Authorized Nest dealers can purchase Google Home direct from the manufacturer.

-

Josh.ai is garnering attention in the installation channel for its natural-language processing tailor-made for custom home integration.

-

Home Automated Living launched arguably the first viable voice-enabled home-automation system in 1994, and the company is still at it.

-

IBM is combining its Watson artificial-intelligence engine with connectivity solutions from Harman to create “voice-enabled cognitive patient rooms” in hospitals.

-

Parks Associates research indicates 40 percent of U.S. smartphone owners use voice-recognition software, generally eclipsing the use of phones for streaming music to speakers or video to a second screen.

-

ABI Research predicts more than 120 million voice-enabled devices will ship annually by 2021.

-

At CES 2017, Dish became the first TV/DVR service to integrate directly with Amazon Alexa.

Back in 2012, we named “alternative inputs” as a Top 5 trend, noting especially the new reality of voice and gesture controls that were starting to taking off.

Remember the CES demos where people waved their hands around to control the TV? And how Siri was seen as the next big thing in home control?

We’ve seen these technologies evolve, but something happened in 2015 that changed everything: Amazon Echo (the product), followed by Amazon Alexa and Alexa Voice Services (or AVS, the platform).

With far-field microphones and a highly accurate speech recognition engine that learns over time, Alexa changed our collective attitudes about speaking into thin air to do things like playing a song, assembling a shopping list and, eventually, controlling our home-automation devices.

Virtually all the respectable home-control systems and subsystems (lighting, thermostats, etc.) support Alexa today, and we now have numerous smart devices embedded with AVS for native voice control, bypassing the need for an Amazon Echo.

We even have a strong competitor in the new Google Home and the Google Assistant speech-recognition engine, which builds on a rich history of Google search functionality and learning algorithms (artificial intelligence, or AI), as well as an ecosystem of smart devices from Nest.

After years — decades, really — of rejecting voice control for its unreliability, home-technology integrators are embracing the technology because of improved speech engines, accurate far-field communications and a plethora of mics in the home.

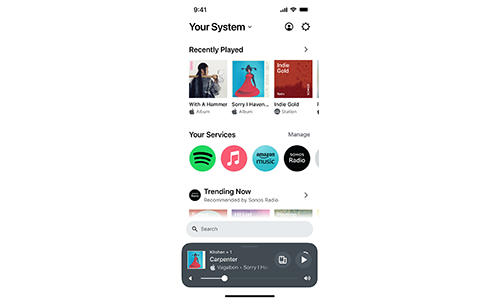

As they do with mass-market DIY products from the likes of Sonos, integrators see voice control (Echo in particular) as a vehicle for smart-home attachments. But they’re also including the low-margin technology simply as a way to improve the user experience.

“We’re selling it on every project,” says Steven Brawner of ProAudio Georgia in LaGrange. “My clients are loving it and it integrates flawlessly with RTI [home controls].”

He shrugs off the naysaying integrators who believe today’s voice controls are inappropriate for custom projects: “Our job is to take all this technology and enhance the experience that our clients have. We are out there to make the technology work for our clients, not against our clients.”

“We get to ride the coattails of some very big marketing budgets bringing awareness to home automation,” adds Pat Hagerman, principal of CyberManor, which has created an Alexa experience in its Silicon Valley demo home. “Echo is an enabling technology that gets us into the home.”

2. Virtual Reality and Augmented Reality | julie jacobson

Virtual reality began as a fun way to play games or otherwise immerse yourself in entertainment. Now the technology — which lets users “live” in an alternate reality, thanks to 360-degree cameras and metadata — has moved on to bigger and better things.

AR as a Service

Smart Glasses — the AR equivalent of goggles for VR — will take off in 2017, largely as a tool to increase safety and productivity in the workplace. But consumer applications abound for things like navigating a road or ski slope, or eyeing and recording a neighborhood for suspicious activity.

To support all of these activities, a new market is emerging for AR-as-a-Service. Start-up Aira, for example, provides a platform that connects visually impaired individuals with virtual agents who can “see” through the client’s own smart glasses to help them navigate. The agent, in the case of Aira, is a real person.

Xpert Eye is another company exploiting augmented reality for remote services. In the case of telemedicine, Xpert Eye enables less-skilled specs-wearing workers to examine ailing clients onsite, while skilled medics diagnose the patients and advise on care from a remote location. In emergency situations — on the battlefield or in an ambulance — local care providers can relay information to doctors far away, who in turn can direct the providers via prompts on the “screen.”

These types of services will play out in homes, where customers train their eyes (or smartphones) on troublesome devices, and remote techs diagnose problems.

VR is used to do everything from visualizing a heart for surgery to demonstrating a home automation system. Lowe’s employs VR to help shoppers select cabinets and paint colors. The Uffizi Gallery in Florence, Italy, is making its sculptures available for 360-degree viewing. The list goes on and on.

And then there’s “augmented reality,” in which images and data are transposed onto “real” reality, allowing users to imagine a refrigerator in their own kitchens, view the name and height of mountains in their view, and capture Pokémon right in front of them.

Between VR and AR, there are many compelling use-cases for integrators. Already, they are starting to sell related technologies to their clients (headsets, cameras, servers, cables, etc.), but they are also using AR and VR to demonstrate smart-home solutions, particularly to clientele who may not be familiar with the possibilities.

At CEDIA 2016 in September, IC Realtime, developer of 360-degree cameras, gave presentations on using VR for marketing purposes. The security giant Interlogix provides VR kits to help its dealers promote smart-home solutions. The A/V buying group Azione garnered wild applause from dealers when a VR-enabled smart-home demo package was proposed.

Also at CEDIA 2016, Jonathan Law’s Utah-based integration firm REAL Audio Video demonstrated the company’s new Virtual Reality Home Cinema system that lets customers “see” their home theater before construction begins. After clients select carpet color, acoustical treatments, speakers, screen size, seating and other home-theater options, REAL converts CAD drawings into a VR-friendly format for an interactive customer “walk-through.”

In London, high-end integration firm Andrew Lucas is using VR to showcase its projects, and the company plans to offer its VR solution to other integrators, as well as manufacturers and allied trades.

Integrator Electronic Design Group in Piscataway, N.J., is just finding its way around VR. EDG principal Bob Gullo says it started when the company was looking for a unique leave-behind at college job fairs, where EDG recruits. He decided on Google Cardboard (an outsourced version with EDG branding) mostly as a gimmick. But as EDG went on to hand out the product to trade partners, the company began to include its own content — mostly immersive video of custom projects — on thumb drives.

3. Device Discovery and Data Collection | julie jacobson

We toiled with this Top 5 trend for a couple of reasons. First, it seems so tired; second, it’s just so big.

Let’s take the biggest example: Google. It reads your gmails and knows from your Delta confirmation when you need to leave for the airport, which route to take and where your gate is. It shows you this data on your Google Pixel phone, and then might instruct your Google Home IoT hub to adjust the Nest thermostat.

The Data of Difference

You know when you get a feeling that “something just isn’t right?” Now you can quantify it.

A new product category is emerging: products that determine if something is out of whack. That could be a noise, a sight, or a person. These products just sit there, taking it all in, getting a feel for the place. After some time of “listening,” they get to know when something is out of place. They’ll let the user know about it.

For example, Cocoon makes a device that monitors infrasound (under 20Hz) and lets the property owner know if something sounds different than usual. Maybe there’s a mouse in the wall? A slow leak somewhere?

Audio Analytic, a leader in the field of its same name, makes technology that differentiates between breaking glass and crying babies. It recently introduced an “ambient” version of its technology that alerts the user if things start to sound funny.

In telemedicine, Neurocern and others are creating solutions that help to detect and monitor dementia. A network of sensors captures changes in a resident’s gait and in-home transitions, alerting loved ones if an elder is showing signs of dementia — a diagnosis that is missed by doctors some 60 percent of the time because they lack trending data.

This is what we mean by “home automation.” You don’t set a schedule or swipe a keypad or even utter a command. The artificially-intelligent environment, in this case “Google Now” platform, learns your activities and responds accordingly. If it fails, you correct it, and it does better next time. The environment needs data, and there are more ways to collect than ever.

For example, Domotz (which owns Fing), Krika and Ihiji are just a few of the custom-centric suppliers that allow users to provide more details about IP devices that show up on the network, making everyone’s network smarter.For starters, more products now broadcast their existence (and their abilities) via IP, Bluetooth or other standards, like Apple Home and Google Cast. That data is then curated through crowd-sourcing.

If my unknown smart TV puts out the same IP signature as your labeled device, then there’s a good chance the system knows what kind of TV I have, and how to control it. These data-capture and -curation mechanisms will be a major trend in 2017.

Once data about these devices is captured by the “system,” we can get a pretty good picture of what’s in the house (or car or person). We also know how products interact together.

If my new smart TV bugs out whenever my smart car pulls in the driveway, what can we learn about the network and how can we fix it?

These scenarios also play out in Domotz, Krika and the others, which can connect dealers with others who are experiencing similar problems with the same products. Meanwhile, suppliers benefit from learning how their products are being used (or not) in the field.

And that brings us to service revenues, known generically in our industry as recurring monthly revenue, or RMR. Data collected from connected devices, cars and people can be used to service customers remotely, often without them knowing.

Integrators can chronicle these services — the data is collected, after all — and bill for them, which has always been tricky for dealers on a psychological and logistical level.

Newcomer Digital Butler, through its app, allows integrators to set up a video conference with clients for remote customer support. The videos are recorded for the customers’ future reference but also logged on the back-end for billing.

Most leading networking companies in the integration channel now offer remote monitoring and diagnostic solutions, with some providing the means for dealers to bill and collect on the “invisible” services.

We should expect a crop of new remote-support operators in 2017, bolstered by all of the data in and around the connected home. AAA for the home. It’s coming.

Next: Tech Deployment, Fiber Prewiring.{pagebreak}

4. New Models in Tech Deployment | jason knott

The traditional models for how home technology is purchased and then installed by consumers were turned upside down in 2016. There used to be just a few options available. Consumers could:

- Buy products online or at a local shop and try to install it themselves.

- Hire a mass-market provider such as the Geek Squad, Comcast or ADT.

- Commission a custom integrator to design and install a system.

Suppliers Mix it Up, Too

Consumers aren't the only ones seeking modern-day shopping experiences (e-commerce) and painless delivery processes.

The digital revolution is also taking hold at the business-to-business level. Companies like SnapAV and Sonance led the way with portals for dealers to purchase products across a broad range of products and track their orders.

Control4 followed suit, and then Core Brands. After just one year, about 60 percent of Core Brands purchases now come through its portal.

AVAD announced recently it would be less centered on its 23 physical locations and shift to a model focused on centralized hubs. And Russound recently outsourced its inventory to a third-party logistics company, reducing the need for a warehouse (that needs to be heated during New England winters).

Today — inspired by Millennials and the larger on-demand economy — new choices have emerged for deploying both DIY and pro-centric solutions. Providers now offer same-day delivery, on-demand installs, remote commissioning, pay-as-you go security monitoring, leased equipment, corporate brick-and-mortar stores, and “free” gear from utilities, homebuilders and other self-interested parties.

Popular websites that offer “Do It For Me” installation service are HomeAdvisor.com, Enjoy.com, Buzztech.com, Hellotech.com, Thumbtack.com, and LevelUpYourHome.com. Some integrators are embracing the new paradigm, and finding success.

Richard Berrie, president of iHummingbird in Delray Beach, Fla., is aligned as an installation resource for several of the online referral services to garner leads.

“What I realized is that you need to be in front of your customers in any way you can,” he notes. “Enjoy.com came out one year after I did. They ripped off some of my concepts. I take that as a compliment.”

Hand in hand with these new lead-gen sources is the need for transactional-type websites. iHummingbird designed its company website to cater to the on-demand generation with a fully transparent menu of entry-level name-brand products with labeled installation prices; however, it does not handle e-commerce.

“I wanted people to feel that home automation is something that they can afford,” says Berrie. “There are no hidden fees, so I post the install prices for those simple devices. I want them to get a taste of the type of service that we provide. Once they get that experience, they are going to trust us for everything else. And they do. They always want a whole bunch more stuff and they refer us to their friends.”

But while the website menu shows Nest, Sonos, Apple TV, Ring, August and other recognizable consumer brand names, the company is not aimed at entry-level customers. Indeed, iHummingbird’s average installation is $35,000, but consumers can still access the company for installation for less than $1,000. The company offers a basic service level in which devices are installed but not integrated, and an elite level that connects devices using Savant.

The company does not install any hardwired audio or video distribution, DVD players or receivers.

“When I started iHummingbird, everyone told me I was crazy … that these products offered no margin and I was turning my back on the industry,” comments Berrie.

He’s not alone. Integrator Refresh Smart Home in Mount Kisco, N.Y., has taken it to the next level by allowing e-commerce on its website for installation. Homeowners can order packaged installation solutions for security, indoor air quality and energy efficiency.

According to Mike Ham, VP of business development, Refresh Smart Home is selling and installing about 150 Nest thermostats per month from its website leads.

5. Fiber in the Home | bob archer

“There is no such thing as ‘future-proof’ in our industry. We don’t use the word anymore,” says Dennis Sage, president of CE Pro 100 integrator Dennis Sage Home Entertainment (DSHE) in Phoenix. His statement sums up the challenge integrators face with ever-increasing demand for more bandwidth in the home. It’s one reason DSHE now installs conduit to accommodate fiber whenever possible.

Robert D’Addario, president and managing director, Cleerline Technology, echoes that, saying that in addition to A/V, emerging markets like the Internet of Things (IoT) are driving interest in fiber.

Terminating Fiber Onsite

Terminating fiber in the field used to be daunting, but not anymore.

“It takes 20 seconds to terminate fiber,” says Marty Hayse, director of purchasing at Dennis Sage Home Entertainment. “It’s not an issue.”

In the past, fiber termination equipment was expensive, it was a slow process, and the cable was fragile. It was also potentially dangerous for technicians, who were susceptible to getting micro-particles of glass in their eyes.

Today, affordable termination kits allow techs to terminate both single-mode and multi-mode fiber efficiently and much cleaner. Installers will need a fiber-optic cleaver, visual fault locator, fiber strippers and Kevlar shears.

DSHE takes the cable service providers’ signal and typically drops five to six fiber runs in a home, at a cost of only about $400 to $600. Hayse says the only drawback that remains is pulling the cable, which can stretch. Using conduit can help avoid that problem.

“What works today might not work tomorrow. I’m a big advocate of putting in an infrastructure that you know you’ll be able to utilize regardless of the format of the future,” D’Addario explains. “Traditionally that was coax, then Cat 5e, then Cat 6, but now we’re saying emphatically fiber.”

4K with HDR is a perfect example of the dilemma dealers are facing. While standard passive HDMI cable is still viable for single-room applications as much as 30 feet, fiber may become the de facto solution to routing full 4K@60Hz with HDR at a 4:4:4 chroma subsampling rate to multiple displays, or when simply connecting between component racks to displays, projectors, satellite dishes, and even access points.

For integrators, it’s problematic because when incompatibility issues with HDMI crop up, the signal goes black; but with 4K the homeowner might still view images, just not with HDR.

Imaging Science Foundation’s Joel Silver says the current Ultra HD Blu-ray players are outputting data rates of roughly 13.5Gbps. Once these signals hit an A/V receiver or switcher, they get squeezed down to about 9Gbps and the HDR is gone.

The bottom line, Silver says, is the performance falls short of what clients are paying for when contracting with installation professionals. “The information that came out for years with HDMI is that it was proposing you would get the picture, but it’s not the picture you are paying for,” he says.

Fiber has become a solution to the 4K with HDR problem.

“Fiber is laughing at our HDMI signals,” says Eric Bodley of Future Ready Solutions, noting fiber is certified to send signals at 100GB speeds, while the consumer electronics industry is only asking for 18GB.

Fiber is still more expensive, but the prices have come down. According to Marty Hayse, director of purchasing at DSHE, the cost of fiber is not an issue, especially when compared to Cat 7 or Cat 8 cable.

“The biggest competitor to fiber deployment in the home is wireless, not copper,” he notes. DSHE installs fiber in about 10 percent of the new custom homes it deploys, but the rest of the time it is still a battle with builders and homeowners who are convinced everything needs to be wireless and shun all infrastructure wiring.

Meanwhile, manufacturers like Metra Home Theater Group, Celerity, Tributaries, DVIGear, Cleerline and Straight Wire among others are examining the capabilities of fiber and rolling out products.

Top 5 Home Tech Trends: Looking Back

- Audio and Video Analytics

- DC Power Distribution

- 4K Ecosystem

- The Front Door

- User Empowerment in Home Automation

- Production home building

- Immersive home entertainment

- Engaging home automation

- The aware home

- Cloud-based networking

- High-Resolution Audio

- Mass-Market Home Automation

- Cloud Video Surveillance

- More Sensor Opportunities

- Automated Door Locks

- Enterprise-Grade Home Networks

- Headphones

- Wireless Audio

- Motorized Shades

- 4K Ultra HD TV

- Self-contained security/automation

- LED lighting

- Computer audio

- Voice, gesture, alternative controls

- The cloud

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our digital newsletters!