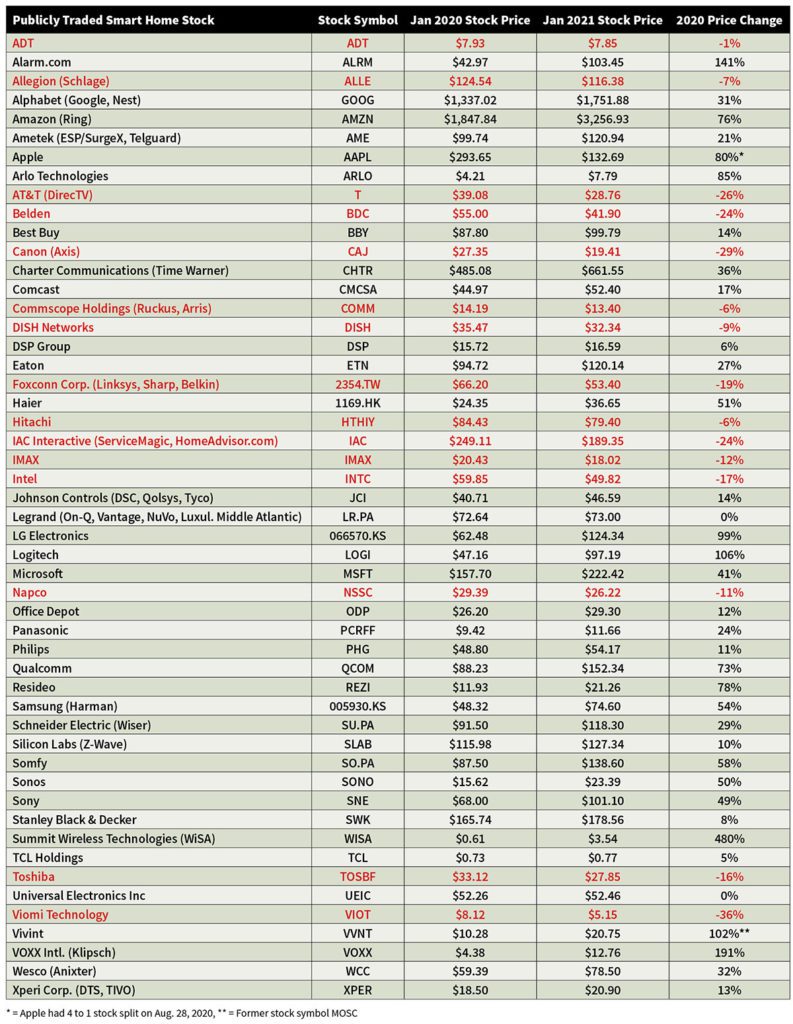

Publicly traded companies engaged in the smart home market finished with another strong year in 2020. The average smart home stock price rose a solid 34.5% with winners outpacing losers by more than two to one.

The smart home stock growth was led by five companies that saw their stock prices more than double.

Overall, 38 companies had stock price increases for the year, while 14 smart home stocks were in negative territory. In 2019, there were only eight companies that had a price decrease, so the losses were definitely more widespread in 2020.

The 2020 smart home stock growth rate is comparable to overall market gains. The Dow Jones Industrials rose 7.25% for the year, while the tech-heavy Nasdaq grew a whopping 43% in 2020. Both stock indices ended the year on all-time highs.

The strong gains come on the heels of a solid year in 2019 during which smart home stocks grew by 29% on average. The 2020 gains for smart home stocks represent a two-year winning streak, so to speak, following 2018 in which the stocks tracked by CE Pro fell 19%.

The list of publicly held companies tracked by CE Pro includes 52 companies this year. The list changes every year as companies buy into the smart home space, or sell their smart home assets. Indeed, some of the notable changes this year include:

- National distributor Anixter was dropped from the list following its acquisition by Wesco in March 2020. Wesco had already been added to the list last year due to the pending acquisition.

- DSP Group, makers of AI and voice control solutions for the market, was added to this year’s list.

- Haier, listed on the Hong Kong stock exchange and the manufacturer of large TV displays, was added to the list for 2020.

- TCL Holdings, the China-based makers of large flat panel displays, was added to the list.

- TiVO was dropped from the list following its late December 2019 merger with Xperi Corp.

- United Technologies, owners of the now-defunct Interlogix security brand, was dropped from the list.

- Vivint was added to the list following its acquisition by Mosaic Holdings for $5.6 billion, which subsequently changed its stock symbol to VVNT.

As always, many of the stock prices (rise or fall) are not necessarily directly reflective of the state of the smart home market. Most of the companies on the list are highly diversified companies engaged in multiple industries, from automotive to commercial security.

2020 Smart Home Stock Winners Include Alarm.com, Vivint

As noted, 37 stocks had price gains in 2020. Of those, 32 had double-digit increases. That is down slightly from 37 companies that had double-digit growth rates in 2019.

VOXX, owners of the Klipsch brand of speakers, was another big winner in 2020. The company’s stock rose 191% to $12.76 per share from $4.38 to start the year. In October 2020, VOXX’s quarterly report (for FY 2021 Q2) stunned investors with sales up 42% and gross margins up a mind-blowing 340%. The company spun from a loss in FY 2019 to a $13.9 million profit. Much of the growth was on the back of Klipsch, which is part of its Premium Audio group of products. Klipsch sales were up 51% to $95 million for the quarter.

Another big stock winner in 2020 was Alarm.com. The company’s stock rose an amazing 141% from $42.97 per share to $103.95. In its most recent Q3 investor report, the company had revenues of $158.9 million, an increase of 24%. It wasn’t just revenues, but also profit, which was $34.5 million for the quarter, up from $26.3 million for the same period last year.

Alarm.com President and CEO Stephen Trundle attributed the strong quarterly results, in part, to the company’s ongoing continued strength in the professionally serviced smart home market in the United States and Canada. In particular, he noted strong growth in residential video. During the third quarter, 40% of the company’s new subscribers opted to include video services with their systems. Most recently, it was publicly announced that Alarm.com would continue to receive royalties from the pending ADT + Google smart home platform being rolled out in 2021.

The only other stocks to more than double value in 2020 were Logitech (up 106% likely due to strong demand for home office cameras due to the pandemic, and Vivint, the No. 1 company in the CE Pro 100. Vivint was purchased in 2020 by Mosaic Acquisition, already a public company trading under the symbol MOSC. Mosaic promptly changed its stock symbol to VVNT, and the company’s stock rose 102% in 2020, from $10.28 per share to $20.75.

LG Electronics almost doubled its stock with a 99% increase in 2020. One other item of note: Apple did a 4-to-1 stock split in 2020. Given the value of the stock today multiplied by 4X, it would equate to an 80% stock price increase in 2020.

Losing Smart Home Stocks

The smart home stocks that did not perform well in 2020 are:

- Canon, owner of video surveillance maker Axis Communications, with a 29% drop.

- AT&T, owners of DirecTV, whose stock fell 26%.

- Viomi, a Chinese IoT smart home platform provider, with a 36% drop.

- Cable manufacturer Belden with a 24% decline.

- IAC Interactive, parent company of HomeAdvisor.com and ServiceMagic, with a 24% decrease.

Last year’s No. 1 smart home stock growth leader was Universal Electronics, which grew 107% in 2019. But just to show how difficult it can be to sustain that sort of growth, UEIC’s stock was flat in 2020, up just 20 cents for the year.