In the custom integration industry, the spotlight often falls on what clients see and touch: lighting scenes, immersive audio, striking displays, and intuitive control systems. Yet beneath every one of those experiences sits an often-overlooked foundation that ultimately determines performance, reliability, and longevity: power.

Data from the 2026 CE Pro Power & Energy Management Deep Dive reveals a clear shift in how integrators view that foundation. Clean, stable power is no longer being treated as a secondary accessory, but as a critical component of modern smart homes. For integrators, this shift represents both a challenge and a meaningful growth opportunity.

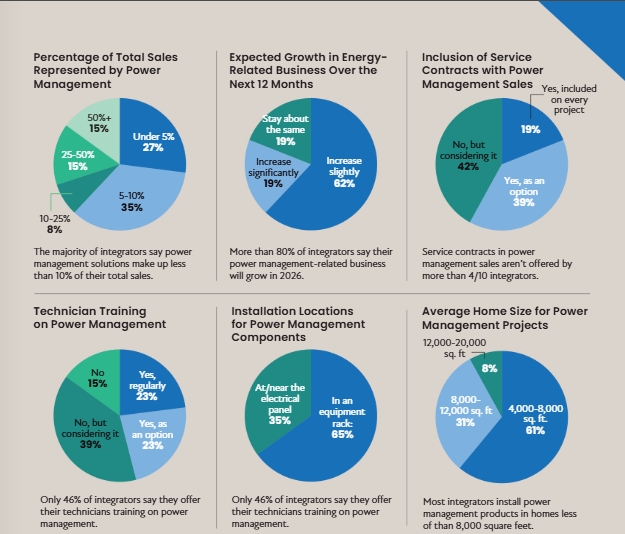

Nearly 85% of integrators sell power management products, yet for 62% of firms, power and energy solutions still account for less than 10% of total revenue. That disconnect suggests power is widely acknowledged, but not yet fully embedded into project strategy or sales conversations.

Kyle Steele of Global Wave Integration believes that needs to change.

“We should be leading with power,” Steele says. “That’s the first conversation. AV and all the other tech should be at the end. If you don’t have good quality power, then nothing’s gonna work.”

Where Power Fits in Today’s Projects

The survey highlights the scale and complexity of projects integrators are delivering. Most firms complete a median of 26 to 50 residential projects per year, spanning new construction (96.2%), retrofit and remodel (76.9%), and light commercial work (76.9%).

Home size further reinforces the opportunity for power management. A combined 92.5% of projects take place in residences larger than 4,000 square feet, with 61.5% falling between 4,000 and 8,000 square feet and another 31% exceeding 8,000 square feet. These homes commonly include networking (88.5%), smart lighting (88.5%), and automation systems (80.8%), dramatically increasing both system complexity and risk.

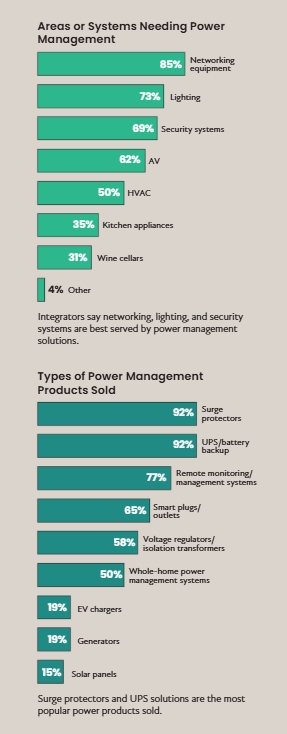

While foundational solutions like surge protection and UPS systems are nearly universal (92.3% each), only about half of integrators currently offer whole-home power management. Emerging categories such as EV charging (19.2%) and solar (15.4%) remain niche, but point toward a broader energy conversation already taking shape.

“It is a cost, but it’s also an investment,” Steele explains. “It’s about protecting the money you’re already spending on the rest of the system.”

Defining the Home’s Critical Loads

When asked which systems most require power protection, integrators pointed first to networking (84.6%), followed by lighting (73.1%) and security systems (69.2%). Steele expands that definition further, arguing that virtually any system with a microprocessor should be considered critical.

“Any loads that have microprocessors,” he says. “That could be smart appliances, lighting control systems, racks, AV components. Those are all critical loads.”

He also cautions that backup generators, while often viewed as a safety net, can introduce “dirty power” that causes sensitive electronics to malfunction. True reliability, he argues, requires a holistic approach that accounts for every microprocessor-driven system in the home.

Business Benefits of a Power-First Model

For integrators, power management directly aligns with the industry’s top priorities: improving system reliability, reducing service calls, and increasing client satisfaction. In the survey, 15.4% of respondents specifically cited fewer service calls as a primary motivation for investing more deeply in power solutions.

Steele’s own experience illustrates the impact. After years of unexplained system issues, Global Wave Integration shifted to prioritizing comprehensive power solutions.

“We had nothing but issues and no one addressed power,” he says. “Then we did one full power project and all the issues went away related to our system.”

Today, that approach has fundamentally reshaped his business.

“I left there with a seven-figure power contract,” Steele says, noting that while such projects are rare, they reflect how much clients value reliability and time. “The one thing most of our clients can’t buy is time.”

Education Remains the Biggest Barrier

Despite growing awareness, 38.5% of integrators say customer education is the biggest obstacle to selling power management solutions, followed by budget concerns (26.9%). Many homeowners still underestimate how power quality affects the systems they rely on daily.

The education gap also exists within the industry itself. While 38.5% of firms are considering formal power-related training, they have yet to implement it. More than half of respondents (53.8%) say technical training would help them grow in the category, and 65.4% want guidance on design best practices.

Power’s Expanding Role in the Smart Home

Looking ahead, power management is evolving into a broader energy ecosystem that integrates utility power, battery storage, solar, monitoring, and intelligent load management. Product selection reflects that shift, with reliability (80.8%), integration compatibility (61.5%), and monitoring capabilities (53.8%) ranking as top criteria.

This evolution also intersects with wellness and lifestyle considerations.

“If you want a healthy home, you need a healthy system and you need that clean power,” Steele says.

An overwhelming 80.7% of integrators expect their energy-related business to increase over the next 12 months. As homes grow more complex and client expectations rise, power management is no longer optional. It is becoming the first conversation, not the last, and the foundation upon which every reliable smart home is built.