The custom integration industry has reached an inflection point in 2026. After several years defined by post-pandemic demand, housing-driven growth, and a sense that “everything was selling,” the market has shifted into a more measured and disciplined phase.

Data from the 2026 CE Pro State of the Industry report shows an industry that is not contracting, but stabilizing. Growth has not disappeared, but expectations have tempered. Success is no longer driven by sheer volume or product availability. Instead, operational efficiency, strategic focus, and professional business practices are emerging as the defining traits of high-performing firms.

In other words, the industry is growing up.

To understand how integrators are navigating this transition, CE Pro analyzed responses from hundreds of custom integration firms across North America and spoke with two leaders operating at very different scales: Andres Klein, CEO of Miami-based luxury integrator Maxicon, and Hagan Kappler, CEO of Daisy, a national brand focused on professionalizing and consolidating the fragmented integration market.

Together, their perspectives highlight an industry that remains healthy, but increasingly divided between lifestyle businesses and firms intentionally building for scale.

Flat Is the New Up

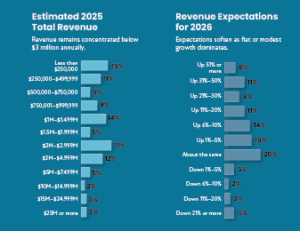

One of the clearest signals from the 2026 survey is a recalibration of revenue expectations. The era of widespread double-digit growth forecasts has cooled, replaced by a more cautious outlook that many describe as muted optimism.

Roughly one in five integrators report that they expect revenue to remain about the same year over year. The largest share of respondents anticipate low single-digit growth, while only a small minority expect outsized expansion.

According to Kappler, that mindset reflects realism rather than pessimism.

“It’s a muted, sort of cautious expectation, but people are still expecting to see growth,” she says.

Rising costs, labor constraints, and pricing pressure are forcing integrators to look beyond top-line revenue and focus more closely on margins, efficiency, and pricing discipline. Growth, when it happens, must be intentional.

That perspective holds true even at the high end of the market. Klein notes that Maxicon’s growth expectations fall within the broader industry’s modest outlook, reinforcing the idea that stability, not acceleration, defines the current environment.

The Scaling Divide

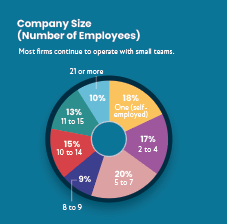

Despite growing professionalism, the integration industry remains highly fragmented. The 2026 State of the Industry survey shows that the majority of firms continue to operate with small teams, and only a very small percentage have surpassed the 50-employee mark.

A significant portion of respondents report annual revenues below $1 million, while the most common revenue band clusters in the low single-digit millions. Very few firms operate at the scale required to absorb labor shocks, invest heavily in service infrastructure, or sustain aggressive expansion without risk.

This structure creates what many describe as a scaling paradox. It is relatively easy to start an integration business. It is far harder to grow past a certain size without fundamentally changing how the business operates.

“It’s just easier to be a $2 million player and get healthy margins than try to grow and get killed,” Kappler says.

Breaking through that ceiling often requires new layers of management, formal processes, and added overhead that can temporarily suppress profitability. As a result, many owners choose to remain intentionally small.

Maxicon represents the other side of that equation. Klein credits the company’s ability to scale with a deliberate move away from the owner-operator model and toward a more structured organization built around dedicated project management, support, and leadership roles.

The takeaway is not that one model is inherently better than the other, but that growth without structure is increasingly difficult to sustain.

Professionalism as a Competitive Advantage

As the industry matures, professionalism is no longer optional. Clients, particularly in the luxury residential market, now expect their technology partners to operate with the same consistency, accountability, and polish as other professional service providers.

Kappler sees continued professionalization as critical to the industry’s long-term health.

“We need to continue to professionalize the industry,” she says. “That’s what ensures durability, even in a downturn.”

Survey responses reinforce that view. Firms reporting higher revenue and stronger confidence heading into 2026 are more likely to have standardized processes, defined roles, and dedicated service or support functions. Smaller firms, by contrast, often cite operational strain and limited internal bandwidth as constraints on growth.

The transition from enthusiast-driven business to professional services firm remains one of the defining challenges facing integrators.

The Showroom Question Revisited

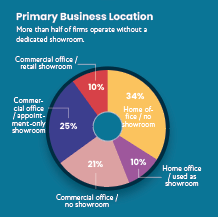

The role of the showroom continues to evolve. More than half of survey respondents report operating without a physical showroom, while others rely on appointment-only spaces or home offices rather than traditional retail environments.

For those that do invest in showrooms, the perceived value remains strong. Klein points to measurable sales lift tied directly to showroom-driven experiences, particularly when selling lighting, shading, and whole-home control systems.

At the same time, Kappler highlights inconsistency as a lingering issue. From a consumer perspective, the lack of standardized showroom experiences can undermine the industry’s perceived professionalism. This points to an opportunity for closer alignment between manufacturers and dealers.

Service Remains the Biggest Gap

As smart homes grow more complex, the gap between system installation and ongoing service has become more pronounced. While most integrators acknowledge the importance of service, recurring revenue adoption remains uneven across the channel.

The State of the Industry survey shows that many firms generate little to no recurring monthly revenue, even as client expectations for ongoing support continue to rise.

Kappler identifies service as the single largest missed opportunity in the industry.

“Chasing volume instead of being strategic about service and pricing creates imbalance,” she says.

Larger firms with dedicated support teams are better positioned to monetize service, while smaller shops often find themselves caught between new installations and reactive support demands. The full report examines how staffing, pricing, and scale influence service adoption across different firm sizes.

From Capability to Clarity

The 2026 CE Pro State of the Industry report reflects an industry that remains in demand, but no longer driven by momentum alone. Labor remains the most commonly cited challenge heading into 2026, outpacing concerns about pricing, competition, or macroeconomic uncertainty. Growth expectations have flattened. Most firms still operate with lean teams and limited organizational redundancy.

In that environment, success is increasingly defined by clarity.

The most resilient integrators are making deliberate choices about where to focus, which categories to pursue, and how to define expertise. Rather than chasing every opportunity, they are narrowing their scope, refining their offerings, and investing where they can differentiate.

“You don’t want to become an emergency room doctor where you know a little bit of everything,” Klein says. “You want to be an expert in what you sell.”

That mindset may be the clearest signal yet that the custom integration industry has entered a new phase, one defined not by unchecked growth, but by professional maturity.