The Latest

Filter by Topic

Filter by Type

Eve Expands Matter-over-Thread Lineup With Eve Thermostat at CES 2026

Eve's local-first smart thermostat debuts with Matter support, Thread connectivity, and no cloud dependency.

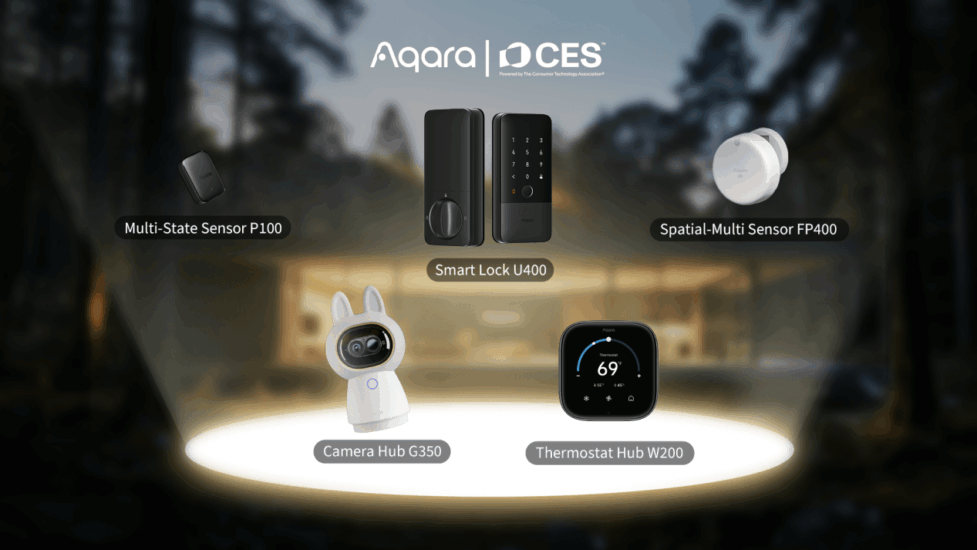

News January 6Aqara Leads CES 2026 With UWB Smart Lock U400, Expands Spatial Intelligence Portfolio

UWB-powered Smart Lock U400 headlines Aqara’s broader spatial intelligence strategy for connected spaces at CES 2026.

News January 6RoseWater Energy’s Joe Piccirilli on Smart Home Power Failures

RoseWater Energy CEO Joe Piccirili explains why power quality and energy resilience are now foundational to the modern…

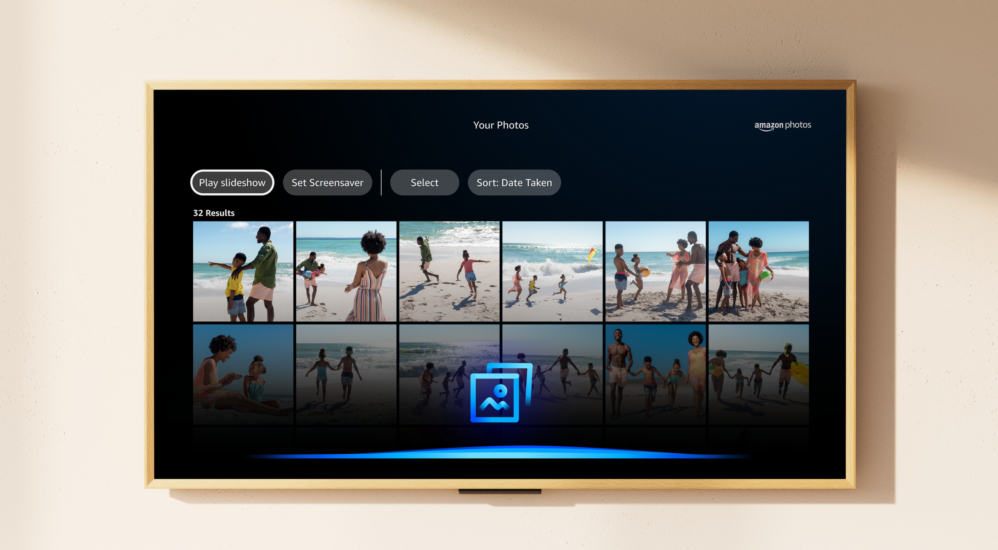

News January 6Amazon Introduces Ember Artline Lifestyle TV, Expands Ring Security Portfolio at CES 2026

Amazon’s CES 2026 news includes the Ember Artline lifestyle TV, new Ring security products, expanded Alexa+ features, and…

News January 6Onkyo Unveils Muse Series, Anniversary Editions and Home Theater Concepts at CES 2026

Onkyo marks its 80th anniversary at CES 2026 with new two-channel streaming amps, limited-edition designs, and future home…

News January 6Klipsch Kicks off 80th Anniversary Year With New Powered Speakers, Desktop Audio

At CES 2026, Klipsch spotlights a redesigned powered speaker lineup and new ProMedia desktop system as it begins…

News January 6Victrola Introduces Soundstage Soundbase and Adds Walnut Finishes to Wave and Tempo at CES 2026

Victrola adds the Soundstage soundbase and Walnut finishes to its Wave and Tempo vinyl products at CES 2026.

News January 6Z-Wave Notches 125-Device Milestone for Long Range Protocol

Debuting to markets in 2022 with its first device, ZWLR has held plenty of promise in eliminating the…

News January 5Hisense Expands Color Technology Across TVs, MicroLED, and Laser Projection at CES 2026

New RGB MiniLED TVs, an industry-first MicroLED display, and expanded laser projector lineup anchor Hisense’s CES 2026 presence.

News January 5