The Latest

Filter by Topic

Filter by Type

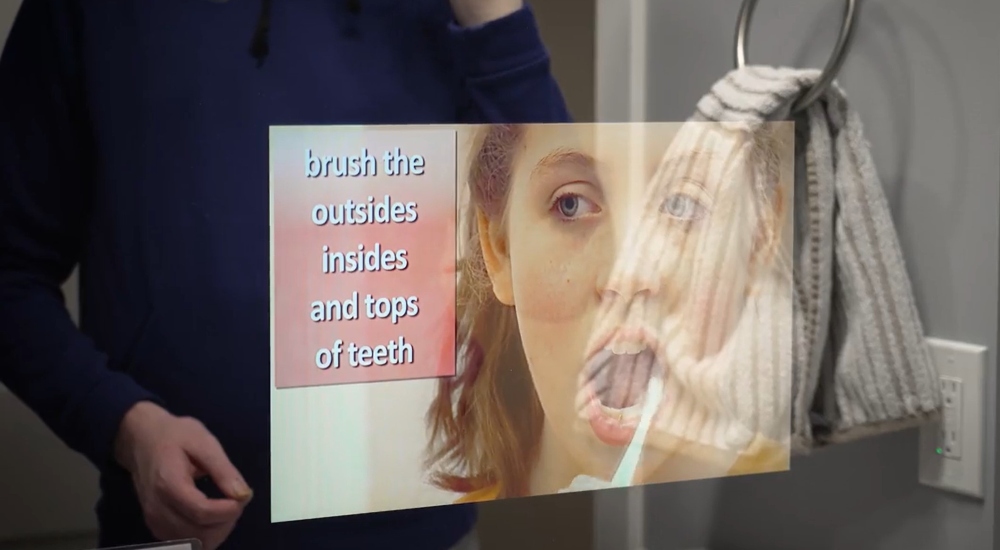

CARES House: A Sensory-Informed Smart Environment Designed for Autism Support

Designed to present itself as a traditional home, the CARES House incorporates a hefty amount of smart technology…

Projects March 4Aliro 1.0 is Out: Here’s Everything Integrators Need to Know

The new standard seeks to create a unified communication protocol for digital keys, providing integrators with simplified methods…

News March 4Daisy Expands with New Franchise Locations in Colorado, Vermont and North Carolina

Daisy signs three new franchise locations in Colorado, Vermont and North Carolina, expanding its services footprint across key…

News March 3The Quiet Talent Shortage: Why Sales Pay Is Climbing Faster Than Tech Wages in CI

While median pay falls in line with broader industry growth, the 2025 Wage & Salary study revealed that…

News March 3Mike Libman Reflects on Innovation and Connection in the CI Channel

DMF Lighting says conversations at CEDIA Expo/CIX 2025 are helping guide its digital lighting innovation, including new Artafex…

News March 3Phoenix Marketing Group to Represent Screen (and Shade) Innovations Nationally

The partnership will see members of the PMG sales team providing pre-, mid- and post-installation support.

News March 2Brilliant’s PoE Control Panel Now Shipping to Professional Integrators

Brilliant’s PoE control panel is now shipping to integrators, delivering power and data over a single CAT5/6 cable…

News March 2How a CIA Remote Viewing Manual Offers a Surprising Correlation to Wireless Networking

In a strange twist, a supposed CIA manual on remote viewing does a pretty good job at explaining…

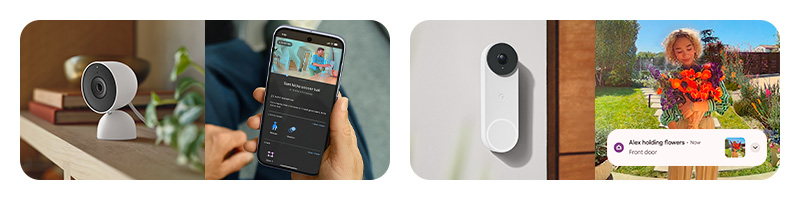

News March 2Google Home Premium with Gemini. Helping You Bring More Value to Every Install.

The future of the smart home is here. And it’s built with Gemini, Google’s most capable AI.1 With one…

Sponsored March 2