Global TV shipments decline 0.6% year-over-year to 52.5 million units in Q3 2025, according to a report by Omdia, signaling a potential reversal in what had been, until recently, a category experiencing explosive growth in the face of economic uncertainties.

Why did Global TV Shipments Decline in Q3 2025?

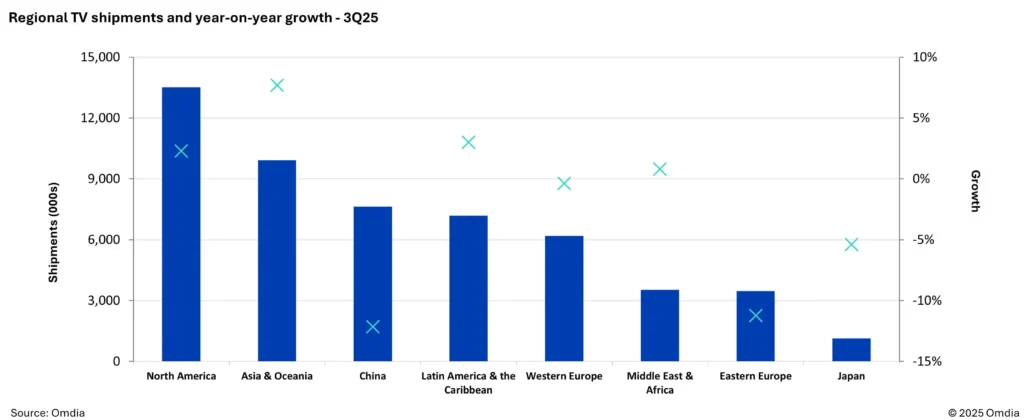

While North America and Asia & Oceania regions saw modest growth, shipments in China dropped more than 11% following the slowdown of government subsidies.

For the last year, demand for TVs in China had seen significant government support to facilitate consumer upgrades, however, in Q3 2025, most of those subsidies ran out, resulting in the massive drop-off in shipments.

As a result of this, Omdia expects an extended period of limited shipping volume into China for TVs.

How China’s Subsidy Slowdown Could Start to Reshape Global TV Markets

For other markets, Omdia sees this an indicator that Chinese brands, such as Hisense and TCL, will look outward to other regions to maintain their market-beating growth momentum, which was up 11% and 2% year-on-year respectively in 3Q25.

In the custom integration industry, tremors of this shift have already begun to be felt as Hisense in particular has been seen making some aggressive market plays in North America that signal focus on building a stronger North American presence. This includes:

- Hiring former Samsung TV executives to head U.S. TV strategy,

- In addition to a growing market share among prominent brands in North America.

“Chinese brands have already made significant progress in taking market share around the world and their subdued local market will likely accelerate these efforts,” said Matthew Rubin, Principal Analyst, TV Set Research, Omdia.

Asia & Oceania Emerges as a Key Growth Region

Regional shipments and year-over-year growth for Q3 of 2025. The blue bars mark the number of shipments while the gray X marks growth. Image courtesy of Omdia.

Despite the drop in Chinese shipments, two markets saw noteworthy growth:

- North American TV shipments rose 2.3% compared to last year,

- While Asia and Oceania shipments grew 7.7%.

On the North America side, those numbers represent a stubborn defiance of the economic impact of tariffs through continual importing of TVs. However, as Rubin points out, tariffs do remain a continual barrier to “quick growth” in the market, meaning that if North American markets continue to grow, it will likely be slow and incremental.

Additional Takeaways: The Cooling of Large-Format TV Screens

Curiously, the slowdown in China has also impacted the rate of growth for the 80-inch and larger segment, with expansion almost halving from over 40% each quarter over the last year, to just 23.1% in 3Q25.

The 70- to 79-inch category, meanwhile, saw year-over-year growth of only 1.1%.

However, rather than highlighting a demand shift in TV preferences among American audiences, Omdia sees this shift as a reprioritizing of brands in regions like Europe and Asia that, traditionally, favor smaller screen sizes compared to American audiences.

As an example, average size preferences for Asia and Oceania countries are a mere 45.5 inches.

What This Might Mean for Integrators

While the large-screen, low-cost strategies favored by Chinese brands likely won’t shift for U.S. audiences (especially as the competition ramps up with RGB LED TVs) where large screens and low-cost entertainment still reign, this shift does hint at greater competition in the TV space as Chinese companies place greater focus on external markets to supplement demand losses at home.

How much this will impact American markets, however, is uncertain as tariffs are likely to provide a substantial barrier towards quick and immediate growth with European and Indian markets, in particular, providing faster avenues to profit for Chinese manufacturers, according to Omdia researchers.