Integrator businesses are increasingly dependent on digital tools to keep projects on schedule, maintain client communication and streamline operations. Yet the 2025 CE Pro Software & Business Resources Deep Dive Survey reveals that many integrators still wrestle with complexity, compatibility and culture as they adapt to a new era defined by cloud-based software and AI.

The deep dive shows that business software has become indispensable for integrators and their businesses—but its success still depends on people, process, and purpose. Integration companies are realizing that the right software, thoughtfully implemented, can reshape the efficiency and profitability of their business.

As Kyle Steele, founder of Global Wave Integration, explains, the survey’s most striking revelation is not simply the spread of AI but its accelerating depth:

“From my perspective, the most revealing insight in this survey is not just that AI is being adopted but how quickly it’s shifting from experimentation to deep integration.”

Setting the Stage: Who Integrators Are and How They Work

Two-thirds (67 percent) of respondents identify primarily as AV integrators, while roughly one-third (31 percent) are involved with both AV and security.

That overlap underscores how the boundaries between entertainment, control, and protection have blurred. For software developers serving this market, versatility is critical, as platforms must handle the distinct requirements of each domain while maintaining consistency in user experience and reporting.

Most integration companies remain small to mid-sized enterprises: 44 percent employ between two and ten people, another 42 percent report 11 to 30 employees, and only a handful exceed 50. These firms operate with lean teams that wear multiple hats, making automation and cross-departmental visibility invaluable.

Nearly half (44 percent) of responding integrators rely on four to five business software systems as the backbone of their operations, managing functions such as accounting, project management, design and CRM. Smaller percentages depend on one to three (36 percent) or six to eight (19 percent) tools.

Steele says this distribution is based as much on necessity as strategy.

“Half of the companies responded with using a handful of softwares (4–5),” he explains. “There’s never been a single piece of software that does everything we need to run a successful company, so the use of AI can effectively aggregate data across platforms for meaningful interactions with the data.”

That insight highlights a key friction point for the industry: the integration of its own business systems. Integrators may specialize in connecting home technologies, but connecting accounting, scheduling and proposal data often proves harder than wiring a whole-home network.

The Cautious and Deliberate Approach to Business Software Adoption

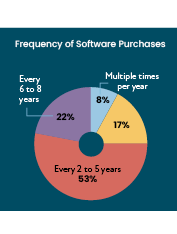

The deep dive data also reveals integrators adopting a conservative rhythm to business software purchasing. More than half (53 percent) of firms upgrade or replace core systems every two to five years, while 22 percent stretch that cycle to six to eight years. Only 8 percent adopt new software multiple times per year.

That slower cadence suggests that once integrators commit to a platform, they expect long-term stability and ongoing vendor support. Upgrades often occur when a product reaches functional limits or fails to integrate with other tools, not simply when a new feature emerges.

This restraint also reflects the resource challenge of onboarding. With limited staff, many companies cannot afford to pause operations for extensive retraining. In that context, compatibility and simplicity aren’t just nice to have—they’re prerequisites for adoption.

What Criteria Do Integrators Find Most Important in Their Business Software?

When ranking what matters most during business software selection, compatibility with other software emerged as the clear leader for integrators, followed by mobile accessibility and customer support. Price ranked fifth, evidence that integrators value reliability and interoperability more than pure cost savings.

The priority order mirrors operational reality: every new tool must coexist with existing accounting, proposal, and project-management systems. A solution that breaks data continuity can create more problems than it solves.

Steele sees a lesson here about intentional design and disciplined adoption.

“The number one reason companies adopt software of any kind is efficiency—more effective billing, improved documentation, and fewer errors,” Steele says. “And yet, complexity remains the top reason software gets abandoned. This only amplifies our belief that intelligent integration isn’t about piling on more tools, it’s about choosing the right ones and harmonizing them into an effortless ecosystem.”

The takeaway: integrators are looking for partners, not just products. Vendors that invest in robust APIs, responsive support, and smooth onboarding will capture loyalty in a market where switching costs, financial and cultural, remain high.

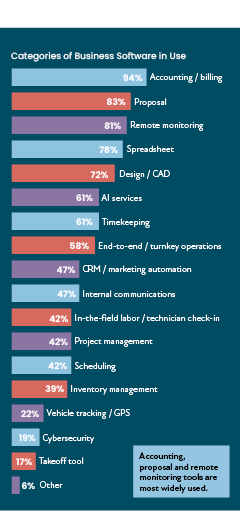

What Business Software Integrators Use Most

Image by Emerald

The survey’s usage breakdown offers a window into where integrators invest their digital energy:

- Accounting and billing software – 94 percent (QuickBooks, Solutions360, Xero)

- Proposal software – 83 percent (D-Tools Cloud, Jetbuilt, Portal.io)

- Spreadsheet software – 78 percent (Excel remains ubiquitous)

- Design / CAD software – 72 percent (AutoCAD, Revit, Visio)

- Remote monitoring software – 81 percent (OvrC, Domotz, BOLD Group)

- AI services – 61 percent (ChatGPT, Gemini, Copilot, Claude)

- Timekeeping software – 61 percent

- CRM / marketing automation – 47 percent

- Cybersecurity software – 19 percent

While nearly every integrator has embraced accounting and proposal platforms, fewer have fully integrated CRM and cybersecurity tools—two areas ripe for growth. The low cybersecurity adoption rate is particularly notable given how many firms now manage clients’ networks and cloud credentials.

Image by Emerald

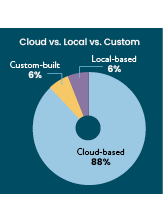

The Unyielding Dominance of Cloud-Based Software for Integration Firms

Image by Emerald

Perhaps the least ambiguous data point in this year’s deep dive: nearly nine in ten integration firms (89 percent) now rely on cloud-based business software. Only 6 percent remain on local installations, and 6 percent use custom-built solutions.

This shift represents a full migration from the on-prem era to the SaaS ecosystem. For integrators, the benefits are obvious: access from anywhere, automatic updates, and reduced IT overhead. But it also means that uptime, data security, and vendor stability have become mission-critical.

In practice, cloud adoption has democratized advanced features once reserved for enterprise users. Proposal generation, automated change orders, and dashboard analytics are now common even in firms with fewer than 10 employees. Platforms like D-Tools Cloud, Jetbuilt, Portal.io, and ProjX360 have lowered the barrier to entry for digital transformation.

Yet dependence on multiple cloud vendors has created new complexity. As one integrator commented in open feedback, “the hardest part isn’t the tool, it’s getting all the tools to talk to each other.”

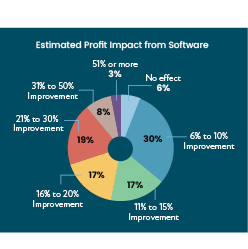

How Integrators Are Measuring the Impact of Business Software

Image by Emerald

The financial impact of these tools is unmistakable. Roughly 94 percent of respondents credit business resource software with improving profitability. Thirty-one percent report gains of 6–10 percent, 17 percent cite 11–15 percent, and 27 percent claim improvements of 16 percent or more. Only 6 percent say the effect is negligible.

The leading value drivers are more efficient billing, better-defined processes, and improved documentation. Together, those functions account for the majority of perceived ROI.

Steele notes that these metrics validate the integrator community’s growing sophistication in using data.

“The data reveals something deeper: companies are no longer asking if AI helps profitability—they’re quantifying how much. Nearly half of firms reported at least a 6 percent improvement, and one in four are seeing significant (16 percent +) gains. From our perspective, this reinforces something we’ve always believed: the right technology, thoughtfully integrated, elevates everything.”

By viewing software not as overhead but as a performance multiplier, integrators are aligning with best practices long adopted in other service industries.

When Software Fails

Image by Emerald

Despite these gains, nearly two-thirds (61 percent) of responding integrators admit they have purchased and later abandoned one to three business software platforms, while 22 percent have discarded as many as seven.

The top cause of abandonment is complexity and systems that prove too difficult for staff to operate. Next come compatibility issues and high cost. Bugs, weak training, and lack of time to onboard also contribute.

For Steele, these pain points reveal both a human and technical gap.

“Most softwares fail when not every user is actively engaged with software. AI can promote better engagement with various tools and softwares across the organization.”

Here again, AI emerges as a possible bridge. Intelligent assistants that simplify interfaces, automate routine data entry, or surface insights contextually could help raise engagement across teams. As one example, an AI layer could automatically flag inconsistent job-costing data across multiple systems, something that today requires manual oversight.

AI Adoption Among Integrators: From Experiment to Expectation

Image by Emerald

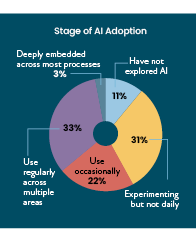

If 2024 was the year AI entered the conversation, 2025 marks the year it entered daily operations. AI adoption among integrators has skyrocketed with a combined 63 percent of firms now using AI either regularly (33 percent) or occasionally (22 percent). Another 31 percent still experimenting. Only 11 percent have not explored AI at all.

Steele interprets this as a cultural inflection point.

“More than 60 percent of respondents are already using AI at least occasionally, and one-third report using it regularly across multiple areas,” Steele says. “This is a clear signal that what was once optional is now becoming essential.”

That penetration rate exceeds early adoption curves for both cloud computing and mobile apps, suggesting AI is moving faster across back-office functions than previous innovations.

Quantifying AI’s Current Impact

Image by Emerald

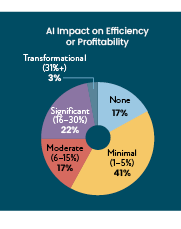

The immediate effects of AI adoption among integrators remain moderate but measurable. Forty-two percent cite minimal (1–5 percent) efficiency or profit improvement; 22 percent report significant (16–30 percent) gains. Another 17 percent see moderate (6–15 percent) results, while 3 percent describe the change as transformational.

That distribution indicates a technology still in its early utility phase, helping with discrete tasks such as report generation, customer communication, and proposal editing, but not yet revolutionizing entire workflows.

Steele says Global Wave Integration approaches AI as a philosophical framework rather than a standalone feature.

“We don’t see AI as a tool; we see it as a mindset—a commitment to efficiency, precision, and responsiveness. It’s not just about keeping up with innovation, it’s about redefining what success looks like in service, systems, and outcomes.”

His perspective mirrors the survey’s broader narrative: integrators who treat AI as strategic infrastructure rather than an add-on are the ones seeing measurable returns.

The Road Ahead: Expansion and Integration of Business Software

Image by Emerald

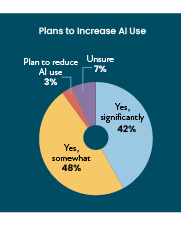

Looking forward, the momentum is unmistakable. Nearly 90 percent of respondents plan to increase their use of AI in the next 12 months, including 42 percent who expect to do so significantly. Only 3 percent plan reductions.

That enthusiasm suggests AI will soon be embedded in nearly every business process, from scheduling to predictive maintenance and marketing analytics.

Steele frames that evolution as both inevitable and human-centered:

“That’s the future we’re building—not just smart homes, but intuitive ones. Not just powerful systems, but peaceful experiences. At Global Wave, we believe AI isn’t about replacing the human touch; it’s about freeing it to focus where it matters most: trust, creativity, and care.”

In other words, automation doesn’t diminish craftsmanship. Instead, it safeguards it by removing friction.

The Cost of Complexity and the Need for Culture

Even as AI promises simplicity, integrators continue to struggle with business software overload. The survey’s abandonment rankings reveal that “too complicated” remains the number-one complaint. Vendors may tout all-in-one systems, but user adoption falters when interfaces overwhelm or workflows feel forced.

For Steele, the answer lies in intentional integration and staff empowerment:

“Intelligent integration isn’t about piling on more tools—it’s about harmonizing them. When AI is used to connect the dots, the software becomes less about data entry and more about insight.”

That principle has organizational implications. Success depends less on which software is chosen and more on how teams are trained, motivated, and supported to use it. Vendors that provide built-in learning modules, onboarding coaches, or AI-guided tutorials can close the adoption gap.

The Human Element in a Digital Business

Perhaps the most telling theme in the 2025 data is the coexistence of automation and artistry. The integrator’s value has always come from blending technology with human understanding, designing systems that feel as natural as they are advanced.

Steele encapsulates this balance succinctly, saying that AI isn’t about replacing people, but rather empowering them.

“When you design systems that think with you instead of for you, everything gets better: efficiency, creativity, and connection,” Steele says.

That ethos may well define the next competitive frontier. As AI handles more of the routine, client experience and service culture will differentiate top firms from the rest.

Reading Between the Numbers with Integrator Software

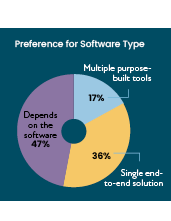

Several secondary findings provide additional context for where the industry is heading:

- Turnkey vs. Purpose-Built: 36 percent prefer single, end-to-end solutions, 17 percent favor multiple purpose-built tools, and 47 percent say, “it depends.” This confirms the rise of hybrid stacks—ecosystems stitched together via APIs and cloud integrations.

- Abandonment Patterns: Firms that report higher profitability also tend to abandon fewer tools, suggesting that well-integrated systems sustain ROI longer.

- AI and Engagement: Companies using AI regularly were more likely to report cross-departmental software engagement, supporting Steele’s argument that AI encourages broader participation across teams.

- Security Gap: The 19 percent adoption rate for cybersecurity software indicates a major area for growth. As more AI and cloud systems connect to sensitive client networks, data protection will become non-negotiable.

The Software Dividend

Taken together, the 2025 survey paints a picture of an industry maturing in its digital discipline. Integrators no longer view business software purely as back-office overhead but as a strategic driver of profitability, consistency, and client satisfaction.

“The right technology, thoughtfully integrated, elevates everything,” Steele says.

Yet the survey also serves as a cautionary note. Without user engagement, cross-platform compatibility, and ongoing training, even the most advanced software can fail to deliver. The firms achieving real gains are those aligning tools with clearly defined processes and measurable outcomes.

Looking Ahead: From Data to Decisions

As the custom integration market heads into 2026, three themes stand out:

- Interoperability is the new innovation. Vendors that make their platforms communicate seamlessly will lead the next phase of growth.

- AI will shift from efficiency to intelligence. Instead of merely speeding up tasks, AI will shape how companies forecast projects, allocate labor, and serve clients.

- Culture will determine ROI. Tools are only as powerful as the teams that use them. Integrators that embed data-driven thinking into their daily habits will realize the greatest gains.

The CE Pro Software & Business Resources Deep Dive confirms that digital maturity is no longer optional. As the industry moves beyond manual processes and spreadsheet management, integrators are becoming true operators of connected business software ecosystems.

With AI as both a tool and a mindset, the integration channel is poised to turn its own operations into the next great case study in smart system design.