The Latest

Filter by Topic

Filter by Type

What WAC Group and AiSPIRE Have Planned for Lightapalooza 2026

While at Lightapalooza 2026, WAC Group and AiSPIRE will be showcasing several new product additions, in addition to…

Briefs February 3Lutron’s ISE 2026 Announcement Shows How Big Intelligent Lighting Has Become

Expanding across the EMEA, the growth seen by Lutron and other intelligent lighting-focused properties highlights the global recognition…

News February 3HARMAN Drops Nine New JBL SCL Speakers (Plus Two Processors and a Receiver)

Marking one of the largest product updates in the company’s recent history, JBL states the new collection is…

News February 3Announcing the Winners of the 2026 Top New Technology (TNT) Awards in Residential

This year’s awards saw 13 separate categories ranging from best software application to the best subwoofers.

News February 3Lutron Acquires Tanury Industries

After supplying metalwork for Lutron for over 25 years, Tanury will have its operations brought in house to…

News February 3Residential, Commercial, and Resimercial Audio Installations: Tailor the Perfect Solution for Any Environment

Understanding the differences between residential, commercial, and resimercial audio installations is essential for anyone designing sound systems that…

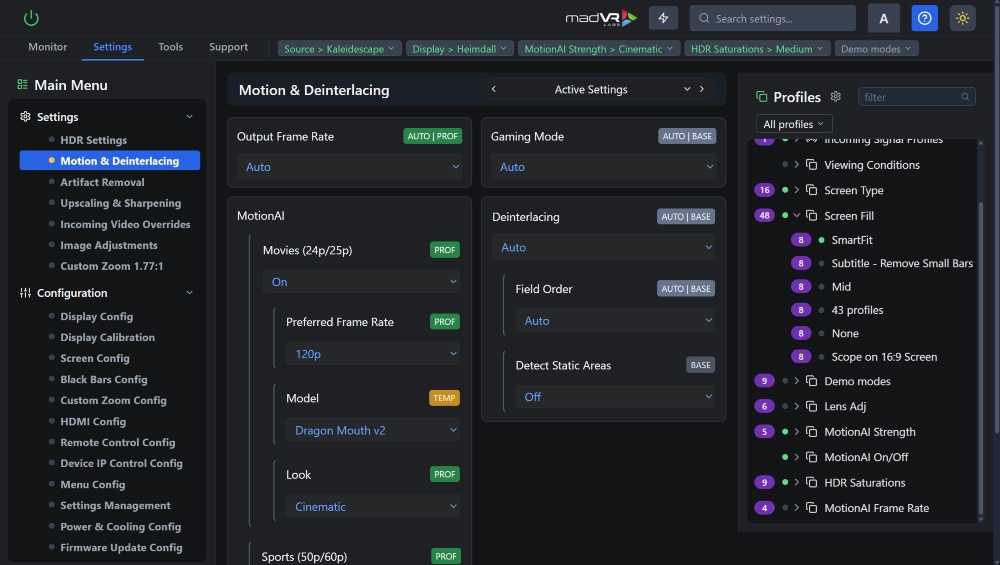

Resources February 2MadVR Moves Towards Software-First Experience on Envy with Commander Web Tool

The new web-based platform is designed for quick configuration of envy systems remotely or in the field that…

News February 2Selective Design to Distribute Spain-made ZION Micro-LED Displays in U.S. and Canada

Spanish luxury display brand ZION is entering the U.S. and Canadian market via distributor Selective Design.

News February 2Stop Outsourcing Profit: Why Outdoor Lighting Is a Natural Win for Integrators

Outdoor lighting uses the same skills as indoor integration while unlocking new revenue and control.

News February 2