The Latest

Filter by Topic

Filter by Type

Residential, Commercial, and Resimercial Audio Installations: Tailor the Perfect Solution for Any Environment

Understanding the differences between residential, commercial, and resimercial audio installations is essential for anyone designing sound systems that…

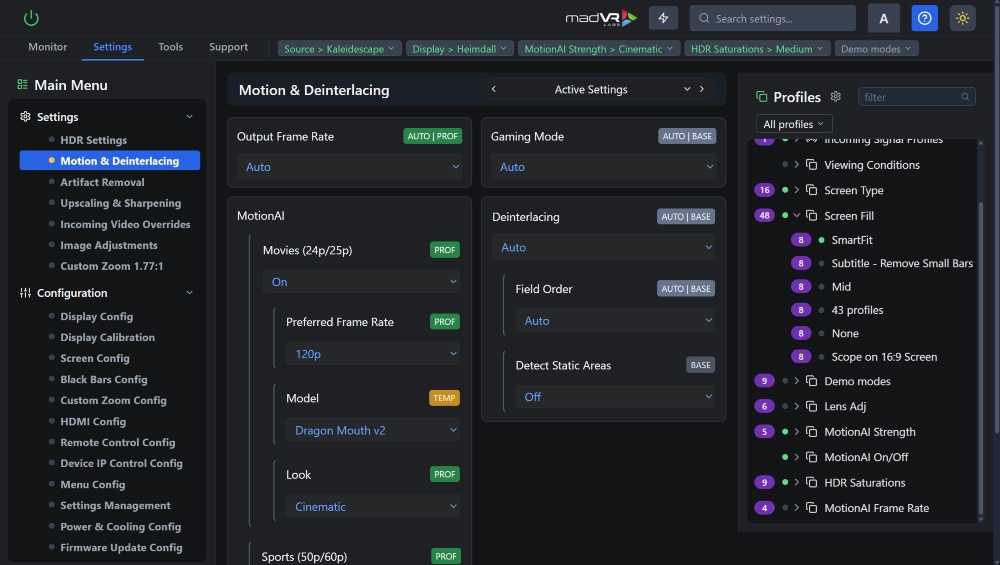

Resources February 2MadVR Moves Towards Software-First Experience on Envy with Commander Web Tool

The new web-based platform is designed for quick configuration of envy systems remotely or in the field that…

News February 2Selective Design to Distribute Spain-made ZION Micro-LED Displays in U.S. and Canada

Spanish luxury display brand ZION is entering the U.S. and Canadian market via distributor Selective Design.

News February 2Stop Outsourcing Profit: Why Outdoor Lighting Is a Natural Win for Integrators

Outdoor lighting uses the same skills as indoor integration while unlocking new revenue and control.

News February 2The Week in Playback: International Developments on the CI Homefront

CE Pro takes a look through all the news static throughout the week to find the stories and…

News February 1Connesso Acquires McPherson Connected Systems

Connesso has officially announced the acquisition of McPherson Connected Systems (MCS). The transaction closed on Dec. 30, 2025…

News January 30Nice is Changing the Way ELAN Works in North America with Yubii OS

The new integration will allow integrators turn Nice’s control platform into a twin-OS offering benefits and integrations with…

News January 30Lightapalooza 2026 News & Coverage Hub

With Lightapalooza generating more and more news with each installment, this live blog page aims to keep CE…

News January 30URC Introduces Roku Integration 3.0 for Total Control Systems

URC is expanding how Roku streaming devices and Roku TVs function within integrated residential systems.

News January 29