Few categories in custom integration have experienced the same kind of acceleration as motorized shading. What was once considered an accessory element that might be added post-installation has matured into a foundational element of the modern smart home, and the 2025 CE Pro Shade Controls Deep Dive Confirms this trajectory.

2025 CE Pro Shade Controls Deep Dive Confirms Growing Category

CE Pro – Emerald

As integrators reported steady demand across residential projects, larger project scopes, stronger collaboration with designers and dependable margins have quickly made shading one of the most reliable categories in the business.

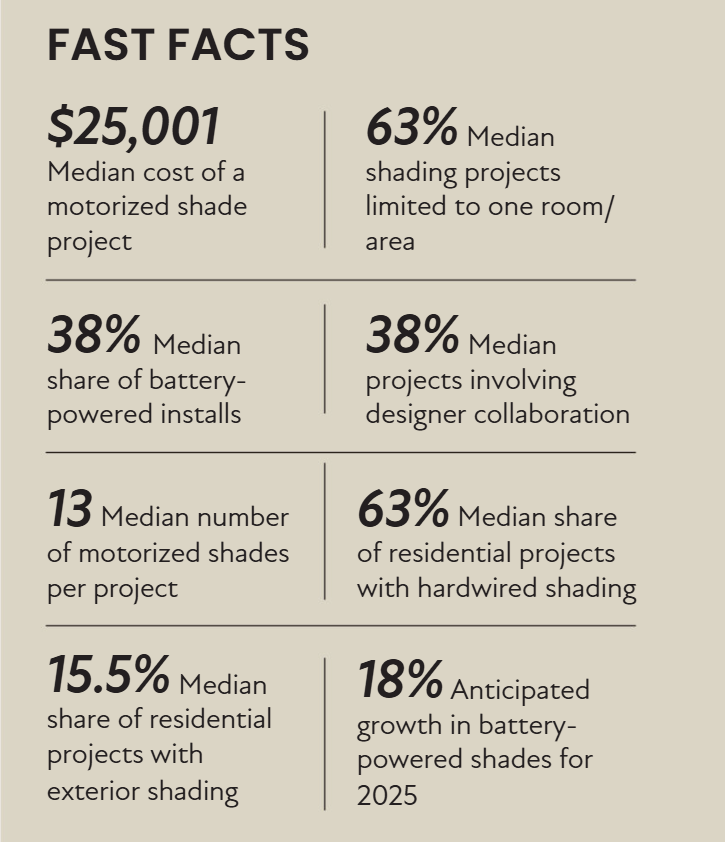

That continues the momentum from last year, when the median shading project included 10 windows and carried a $25,000 price tag.

This year, the median project size grew to 13 windows, albeit with an unchanged median shading project value. The year-over-year increase may seem small, but it signals a category that is not only holding steady, but expanding in scope and depth.

Residential Projects Still the Largest Channel for Motorized Shades

CE Pro – Emerald

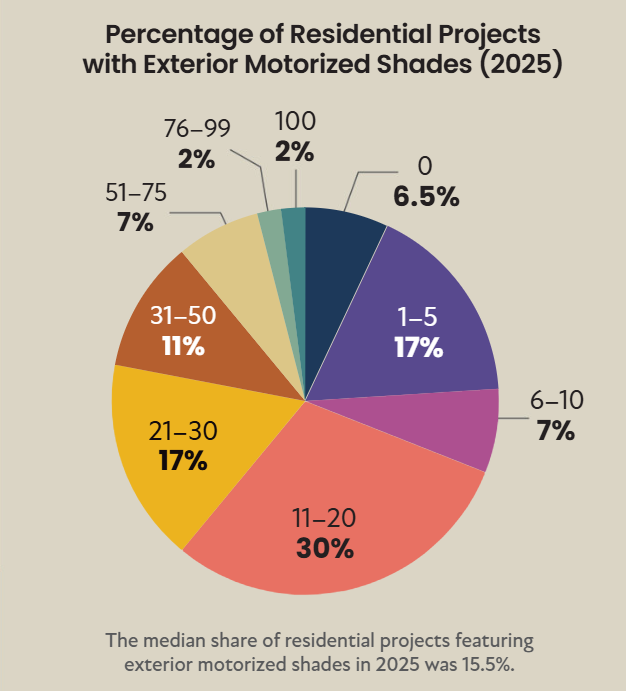

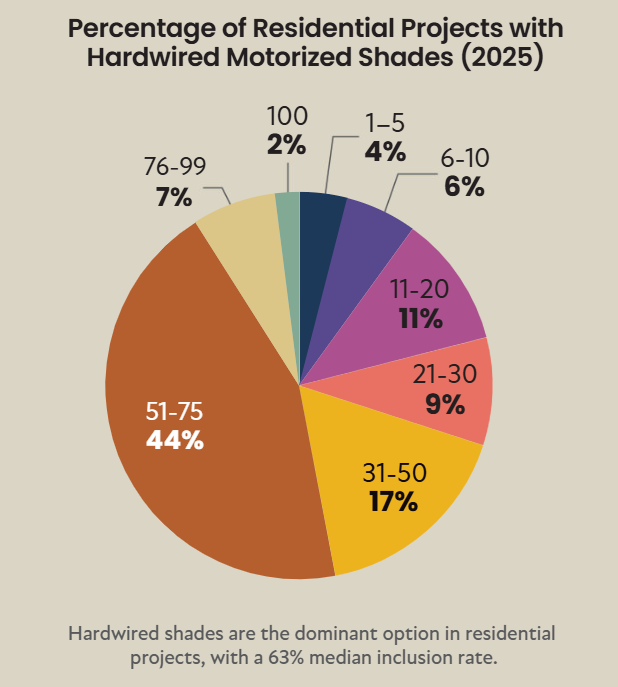

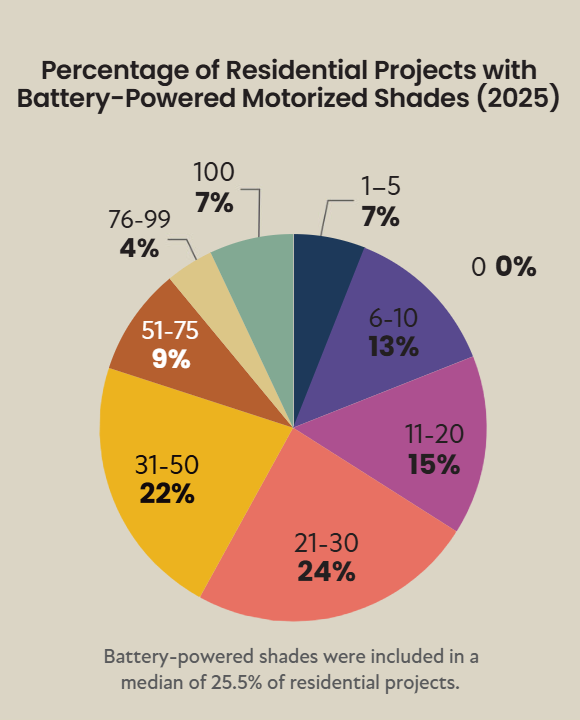

Residential projects remain the foundation of the shading market. In 2025, integrators reported that hardwired shades were included in a median 63% of projects, while battery-powered and exterior shades were in 38% and 15.5%, respectively.

The data reinforces a pattern that began in 2024, when battery adoption was slower but clearly on the rise.

The jump to a 38% median share for battery systems this year shows how quickly wireless has moved into the mainstream, particularly in retrofit environments.

CE Pro – Emerald

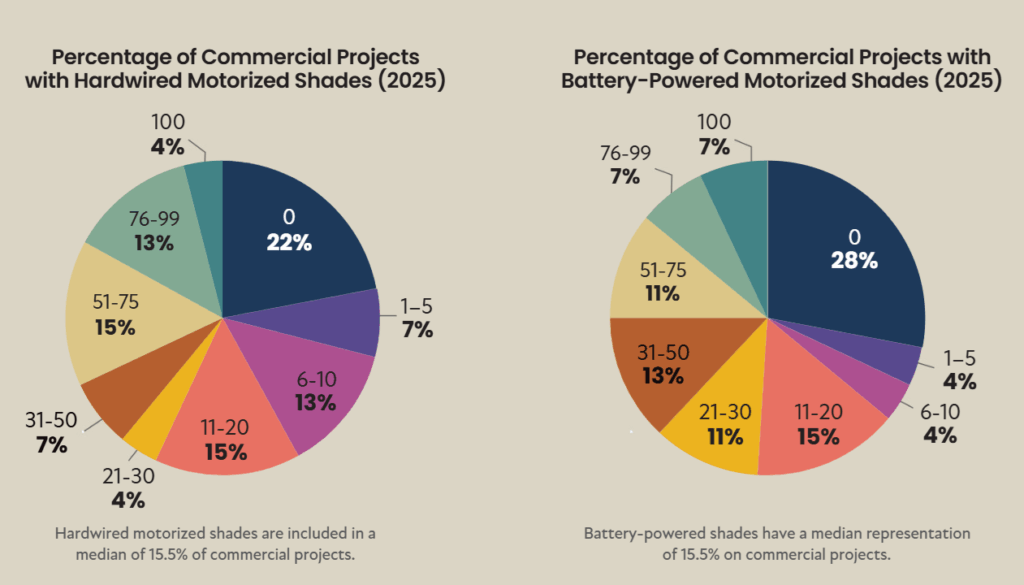

Commercial shading, by contrast, is still underrepresented, comprising a median of just 5.5% of projects. That reflects the same reality identified in last year’s survey, when 80% of integrators said they installed shades in 10% or fewer commercial jobs.

Opportunities in offices, MDUs and hospitality remain largely untapped, but most dealers continue to rely on residential demand to drive business.

CE Pro – Emerald

Average Residential Shading Project Size Grows 30%

Another clear indicator of shading’s momentum is project size. In 2025, the median shading project included 13 windows, up from 10 in 2024. More than a quarter of integrators now say their average job involves 16 or more shades.

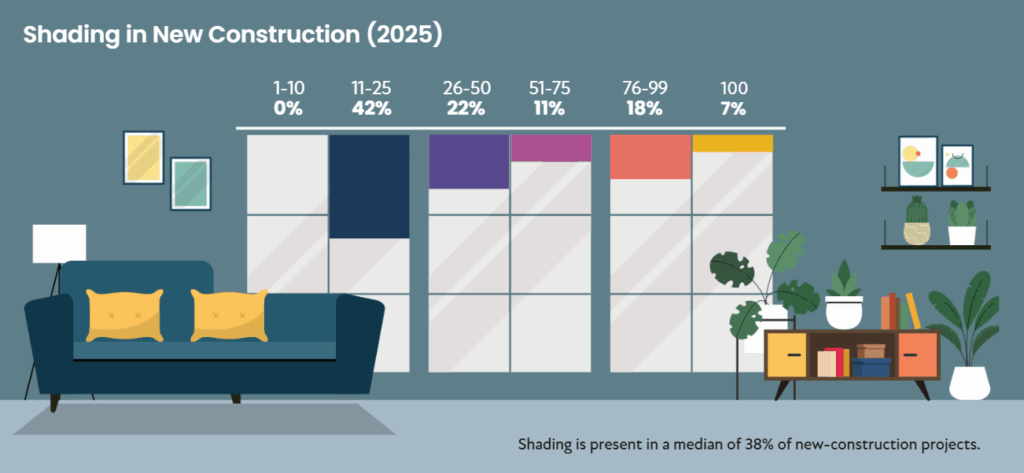

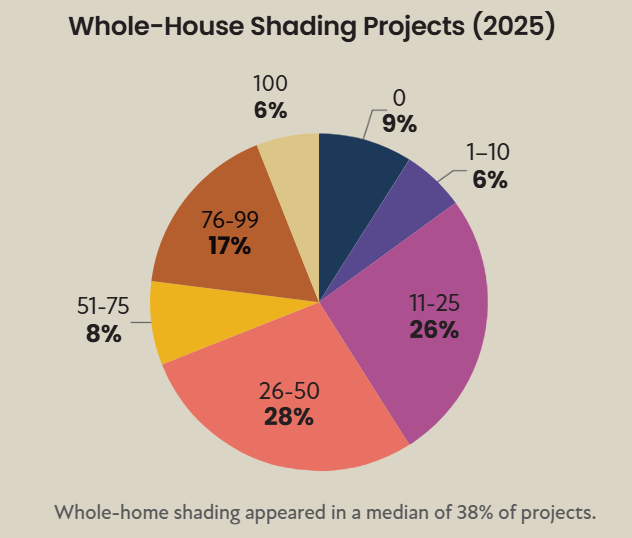

This shift shows how shading has outgrown the “single-room upgrade” model. The survey found that whole-home shading accounted for a median of 38% of projects in 2025, though one-room installs remained the most common at 63%.

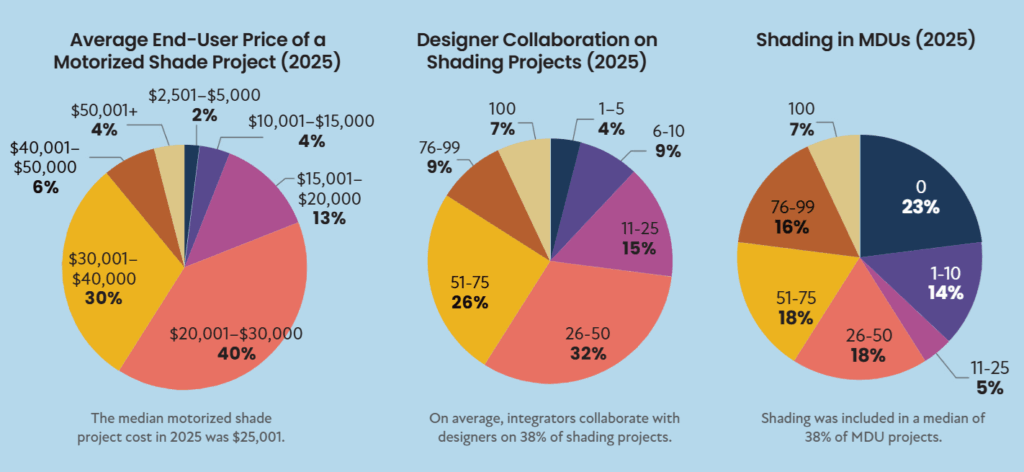

Project values have likewise kept pace with scope. The median shading job now costs $25,001, essentially unchanged from last year’s $25,000.

Stability at this level reflects shading’s maturity as a premium category. Most projects now land between $20,000 and $40,000, with more than one in 10 exceeding $40,000.

Interiors Lead with Outdoors Emerging

Integrators continue to specify shading most often in interior spaces. Living rooms (median 44%), great rooms (29%), primary suites (27%) and kitchens (26%) remain the leading areas for installs.

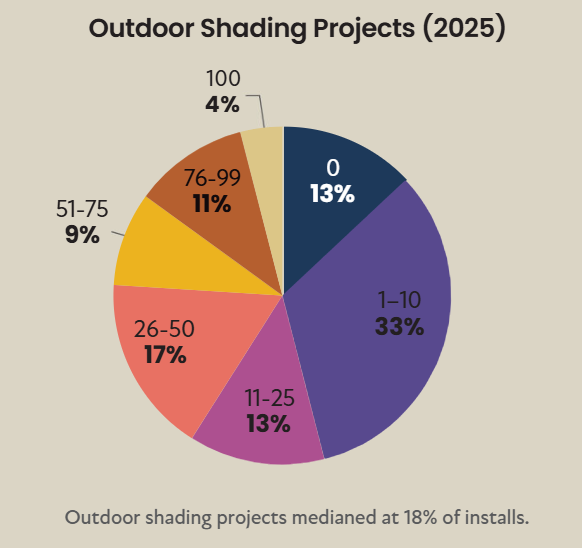

Outdoor shading is showing slow but steady growth. The median share of outdoor shading projects this year was 18%, a figure consistent with the gradual climb noted in last year’s survey.

For dealers in colder climates, selling outdoor solutions requires extra care. Adam Zell, CEO of Boston Automations, says the category can succeed, but only when it is designed to function year-round.

“Indoor treatments will always outpace outdoor due to sheer volume of windows,” Zell says.

“Outdoor solutions are growing but limited in New England by climate. Dual roller systems are necessary here: vinyl shades for cold weather and pollen control (March–June) and screen mesh for warm-weather comfort. Without both solutions, outdoor shading remains difficult to position as year-round viable.”

His point highlights why outdoor shading, while promising, demands more thoughtful engineering than many clients expect.

Interior Designers Main Creative Force Behind Projects

Shading has always involved design decisions, but in recent years, collaboration with designers has become essential. In 2025, integrators reported a median of 38% of projects involving a designer.

That’s an increase from 2024 , when lighting designers were just beginning to become more involved. Today, interior designers are not only part of the process, but they are also often the driving force.

Zell says he is seeing the trend occur firsthand, with his company heavily relying on designers to bring them shading projects.

“Interior designers are now the #1 trade bringing us projects and this number is climbing. Builders are number two, architects a distant number three and electricians number four with significantly less influence. Importantly, interior designers and lighting designers should not be lumped together in surveys. They are entirely separate trades with different priorities and perspectives.”

This growing reliance on designers has broad implications. Firms that build those partnerships may often find themselves introduced earlier in the construction process, giving them greater influence over budgets and scope, while also opening the door to other categories such as lighting and control.

Fabric Options Top Concern When Selecting Motorized Shades

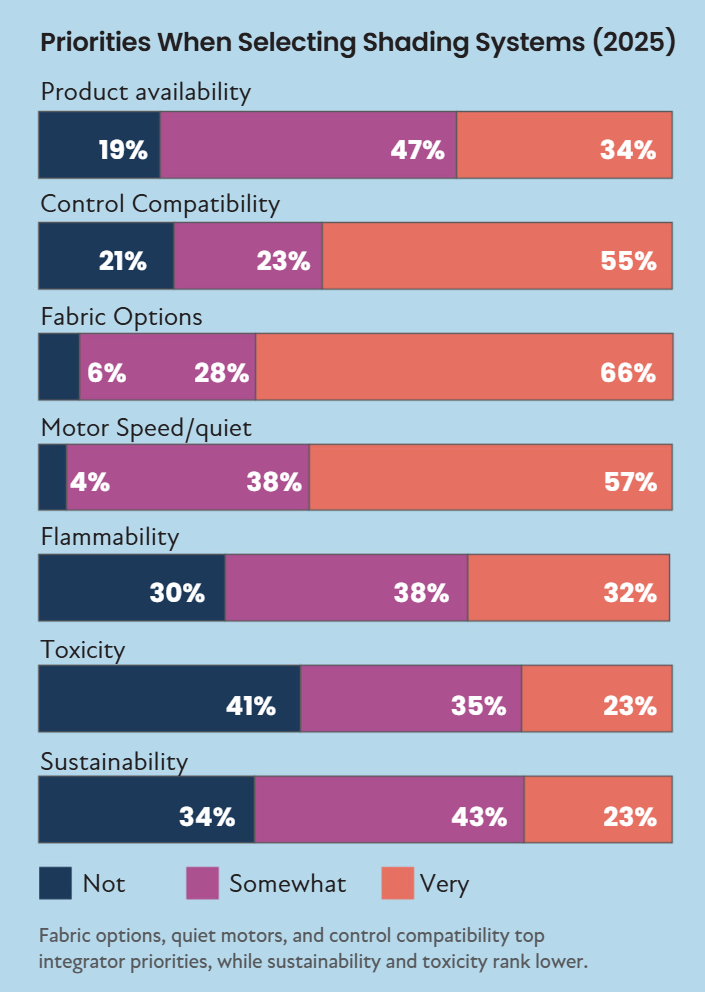

Performance and compatibility remained top considerations when dealers were selecting shading systems in 2025. The survey revealed fabric options (66%), control compatibility (55%), motor quietness (57%) and availability (34% “very important”) at the top of the list.

That ranking is largely consistent with 2024’s findings, when compatibility and motor performance were also high priorities. The emphasis on fabric choices this year reflects shading’s close ties to aesthetics and design trends.

For Zell, however, the issue that most often makes or breaks a sale is availability. He notes that even the most trusted brands can come up short in certain areas, forcing his team to look elsewhere.

“Availability is the #1 deciding factor for our team,” Zell says, adding that the company is sometimes forced to look beyond market leaders for specialty solutions or wider offerings.

On the subject of sustainability, Zell’s experience diverges from some of the industry buzz.

“In six years, we’ve had only one client ask about flammability, toxicity, or sustainability of fabrics. These factors rarely, if ever, influence decisions in real-world projects.”

Wireless Shading Near Parity with Hardwired Solutions

One of the biggest shifts over the past two years has been the rise of wireless. The 2025 survey showed battery-powered shades now represent a median of 38% of projects. Hardwired solutions still appeared in the most projects (63%), however .

CE Pro – Emerald

That represents a meaningful change from 2024, when more than half of dealers said they used battery-powered shades in no more than a quarter of projects. The jump suggests wireless has finally reached parity, creating new opportunities in retrofits and broadening the customer base.

Still, Zell cautions that the headline numbers don’t tell the whole story. In practice, he says, the split is closer to even and cost comparisons between wired and wireless depend heavily on the size of the project.

CE Pro – Emerald

“Roughly a 50/50 split. Wireless wins in less expensive homes, though the cost of battery shades can be nearly equal to wired once power supplies and scale are factored in.”

That nuance matters. Wireless may simplify the conversation for retrofit clients, but as projects grow, economics flatten, reminding integrators that wired infrastructure remains just as relevant.

Smart Drapery and Curtains Gain on Roller Shades

Shading today encompasses more than rollers. The 2025 survey saw blackout shades in 26% of projects, soffit-mounted rollers in 24% and drapery or curtains in more than a quarter of installs. Skylight and curved window coverage also appeared more frequently than in years prior.

For Zell, drapery in particular has become an essential part of the business. He says surveys underrepresent its role and risk overlooking an important revenue stream.

“Drapery is the fastest-growing category in window treatments for us, frequently paired with shades in luxury homes. We’ve invested heavily in learning drapery track integration, though sourcing fabrics and competing with workrooms remains a barrier.”

His perspective underscores how integrators can’t afford to treat shading as a one-dimensional category. Homeowners want layered treatments and solutions for unusual openings and those who can deliver them will stand apart.

Integrators Say Shading Offers Reliable, Low-Maintenance Profits

If there is one thing integrators agree on, it is that shading pays. The 2025 survey showed the median shading project cost at $25,001, almost identical to last year’s $25,000. That consistency reinforces shading’s place as a dependable premium category.

It is not just about revenue, though. Shading has also proven to be low-maintenance, with fewer callbacks or warranty issues compared to other categories. That reliability protects margins and builds confidence among integrators.

Zell sums it up simply: “Our confidence in shading as a long-term, high-margin, low-failure product category is stronger than ever.”

Smart Shade’s Growth Outlook Appears Optimistic

Integrators remain optimistic about the future of shading. The survey showed expectations for 3% growth in hardwired shades, 18% growth in battery-powered shades and 8% growth in outdoor systems.

That outlook builds on the optimism reflected in last year’s report, when most dealers predicted steady sales across the board. The sharp growth expected in battery-powered shades underscores just how quickly wireless has become mainstream.

Zell believes shading will continue to lead but sees lighting closing the gap.

“Shading and lighting are the two fastest-growing verticals in our business, with lighting likely catching up to shading over the next few years. Builders and designers increasingly rely on integrators — not electricians — for lighting design and control due to our technical expertise and understanding of aesthetics.”

Conclusion: 2025 CE Pro Shade Controls Deep Dive Highlights Stability and Strength of Category

The findings of the 2025 CE Pro Shade Controls Deep Dive leave little doubt: shading has become one of the most important categories in custom integration. Projects are larger, pricing remains strong, designers are more involved and wireless has caught up to wired.

Compared to 2024, medians are higher in areas like project size and battery adoption, proving that shading is still on the rise.

“Shading has become the cornerstone of Boston Automations’ business strategy and we see it continuing to dominate as the top growth driver in custom integration,” Zell says.

For integrators, the message is clear. Shading is not a nice-to-have anymore. It is a core category that brings reliable profits, strengthens relationships with designers and builders and opens new opportunities in drapery, outdoor and lighting integration. Those who embrace it now will be the ones leading the market in the years ahead.