For the vast majority of custom integrators, the outdoor technology market continues to be a very sunny one. Dealers are performing more outdoor residential exterior projects and an increasing amount of commercial work as well, based on our CE Pro Outdoor Technology Deep Dive research.

2024 Outdoor Deep Dive Data Highlights

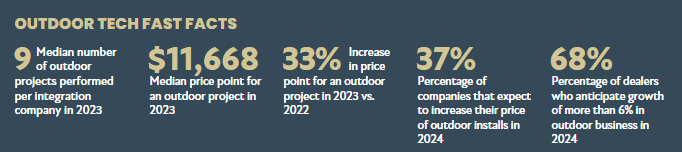

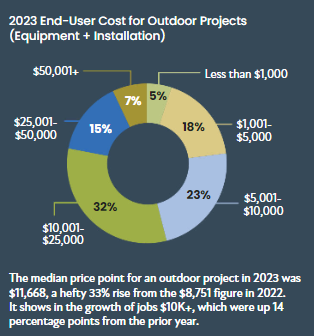

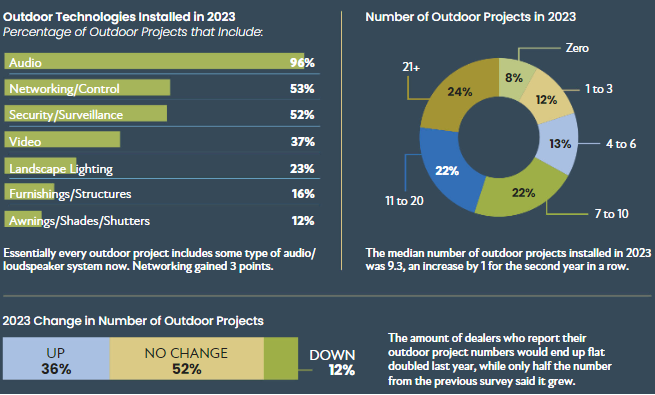

Looking deeper into the responses from our Outdoor Technology Deep Dive survey, which was conducted in January, integrators are pulling in a little more than six figures from their outdoor business. The median project price point jumped by 33% to $11,668 in 2023 as dealers performed a median nine jobs (9.3 to be exact), equating to a solid $108,512 in 2023 revenue.

The number of outdoor projects has risen by one each of the past two years, while they can also charge customers more likely in part due to inflation. But they also simply have more subsystems and compelling solutions options to bring to customers as technologies like security, lighting, and even irrigation control make more headway and vendors develop more outdoor products.

Higher Prices Expected to Carry into 2024

When it comes to the amount of outdoor projects taken on last year vs. 2022, 78% said they did more — nearly one-third (32%) or the same amount.

Five-figure jobs are becoming much more commonplace as integrators cobble together additional subsystems to go with audio, which is installed in virtually every installation.

The percentage of projects priced over $10,000 increased by 14% year-over-year, while those less than $10K dropped 9%.

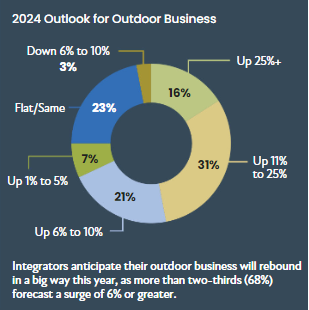

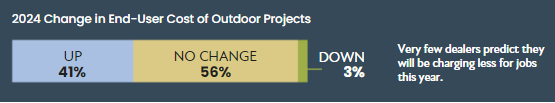

More good news on that front is expected from dealers in 2024, too. At least one-third anticipate increasing the end-user cost (equipment + labor) this year, and two-thirds forecast growth of 6% or greater in their outdoor business — 16% are predicting 25% growth.

Wealth of Tech Options & Innovations to Integrate

Beyond audio systems, dealers are implementing more networking, furnishings/structures, and awnings/shades in their projects as homeowners seek to spend more quality time outside and extend their living spaces.

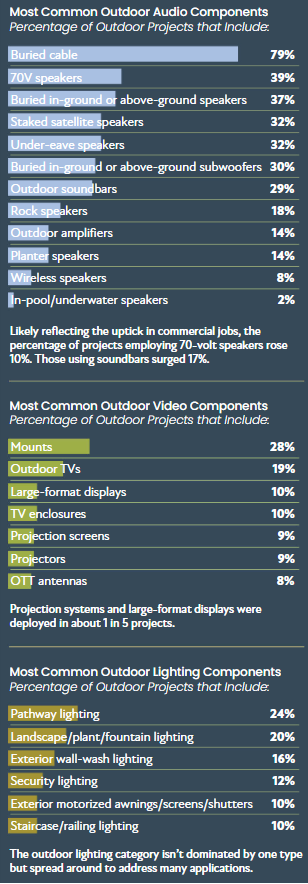

The lighting fixture business has been the darling of the custom integration industry for the past couple of years, and exterior fixtures are just as versatile in their usage and applications as indoor fixtures.

The spread of coverage is represented in the fairly uniform scope of deployment among the various fixture types. Pathway (24%), landscape/plant/fountain (20%), wall-wash (16%), security (12%), awnings/screens/shutters (10%), and staircase/railing (10%) lighting make for visually impressive and practical lighting usage.

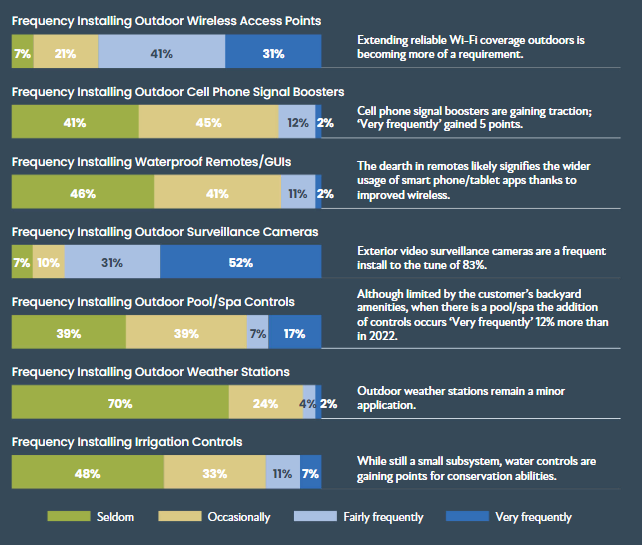

Meanwhile, home networking wireless accent points being installed ‘fairly or very frequently’ increased from 64% in 2022 to 72% last year, integrators report. There’s no question that customers are requesting better and more reliable WI-Fi response and coverage outside.

On the security front, video surveillance systems remain strong in the wake of the pandemic. While security lighting still represents a small piece of the exterior security pie, video surveillance installations — presumably connected to control systems for viewing on multiple displays and easy footage retrieval — climbed 13 points from 2022 to 2023 in the frequency of their use, now in 83% of projects.

Audio Solutions Run the Gamut Including Commercial

As noted, audio remains king of the outdoor technologies. It’s now incorporated in an overwhelming 96% of jobs. That covers a lot of ground, figuratively and literally. Installers trench cable/wire 79% of the time to connect combinations often comprising staked satellite speakers, in-ground or above-ground speakers and subwoofers, under-eave speakers, and 70-volt loudspeakers.

Homeowners often seek audio coverage throughout a backyard, whether on hardscapes, landscapes, mounted, blended as planters and rocks, and even in pools.

The two biggest jumps in installation applications according to our findings from the outdoor technology deep dive came in the categories of soundbars and 70-volt loudspeakers (10% and 17%, respectively). The former is a natural attachment sale to outdoor TVs; the latter appears to validate the more commercial work being done these days.

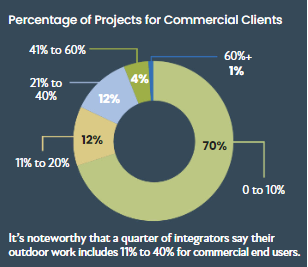

Toward that end, most integrators still stay in their residential lane, but many are finding jobs outfitting the outside areas of restaurants, sports bars, small retail shops, and other resimercial verticals. A quarter of integrators say their outdoor work includes 11% to 40% for commercial end users.

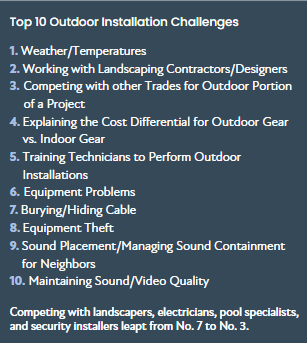

Finally, as always CE Pro inquired about the biggest challenges integrators face in designing and installing outdoor tech systems. Perhaps because more projects are being commissioned, weather/temperature topped the list this year after being third last year (climate change, anyone?), while burying/hiding cable fell from No. 1 to No. 7.

More of a concern these days for dealers is not only collaborating with landscaping designers/contractors but worries about their encroachment on business along with other trades — which can also include electricians, pure-play security installers, and even “the pool guy” these days. Competing with other trades rose from No. 7 to No. 3.

So, how is your outdoor tech business shaping up — lots of sunshine or is it cloudy with a chance of rain? Keep an eye out next year for our annual Outdoor Technology Deep Dive survey and in the meantime, download the full Outdoor Technology Research Report to find out more.