The Latest

Filter by Topic

Filter by Type

Harman Updates Benchmark Eargle Theater

Among the components in the system include six SMA-4750 amplifiers, three SCL-1 loudspeakers, and eight SSW-3 subwoofers.

News October 14L-Acoustics Expands Global Ops Strategy with Real Estate Division

The new division will be run by Gérald Yven and will focus on managing site acquisition, design and…

News October 14B&O to Open a Trio of Stores in California

The Danish AV company is set to open stores in San Francisco, Los Angeles, and Palo Alto.

Briefs October 14TP-Link Demonstrates Wi-Fi 8 Connectivity

The global electronics company states that it has demonstrated Wi-Fi 8 technologies.

Briefs October 14Lenbrook Brands to Exhibit at 2025 Toronto Audiofest

In the Windsor Room the company will show products from NAD, PSB, DALI, Roksan and BLOK, from Monitor…

Briefs October 14Inside Velvære: Utah’s Smart Wellness Community Blending Technology with Koselig Living

Developed by Bonfire Collection Velvære presents itself as an ever-evolving smart community designed around supporting occupant health and…

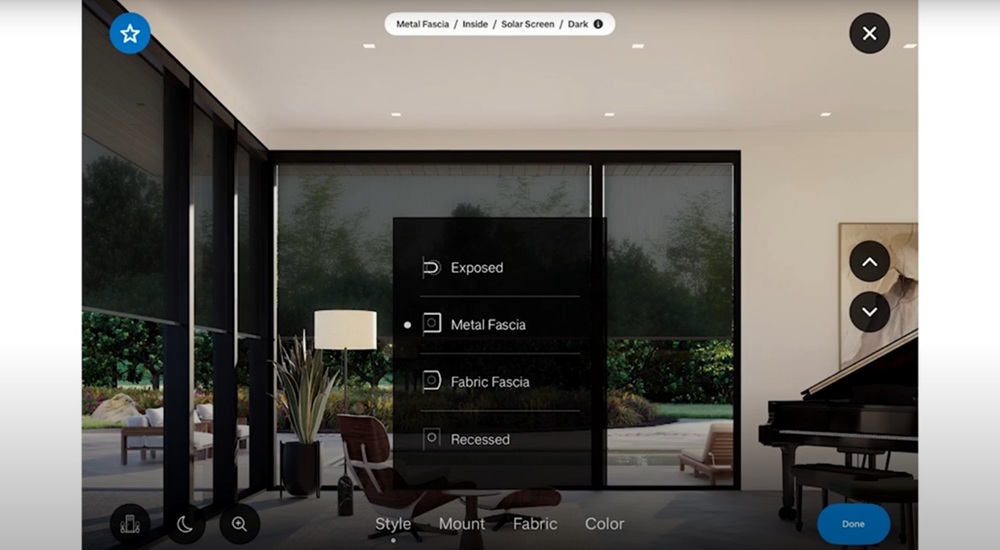

Projects October 13The Week in Playback: The Smart Home Has a New AI Assistant Join the Fold

CE Pro takes a look through all the news static throughout the week to find the stories and…

News October 10Epson Unveils Lifestudio Projectors with Sound by Bose and 4K HDR

The top-of-the-line Lifestudio Grand produces up to 3,600 lumens of brightness and it carries a MSRP of $2,499.99.

News October 10PSB’s Latest On-Wall Speaker Has a Smaller Footprint to Fit More Room Layouts

The PSB PWM Sat On-Wall Speaker utilizes the company's Synchrony-based driver platform that includes a 1-inch tweeter and…

News October 10