The Latest

Filter by Topic

Filter by Type

Daisy’s Hagan Kappler on Leadership, Talent & Building a National Brand

Daisy CEO Hagan Kappler discusses leadership, workforce development, and the future of custom integration at CEDIA Expo/CIX 2025.

News January 22Wellness-Driven Media Room Integrates Cinematic AV with Health-Focused Systems

Global Wave Integration creates a multi-sensory wellness and entertainment retreat, flipping the use case of a traditional media…

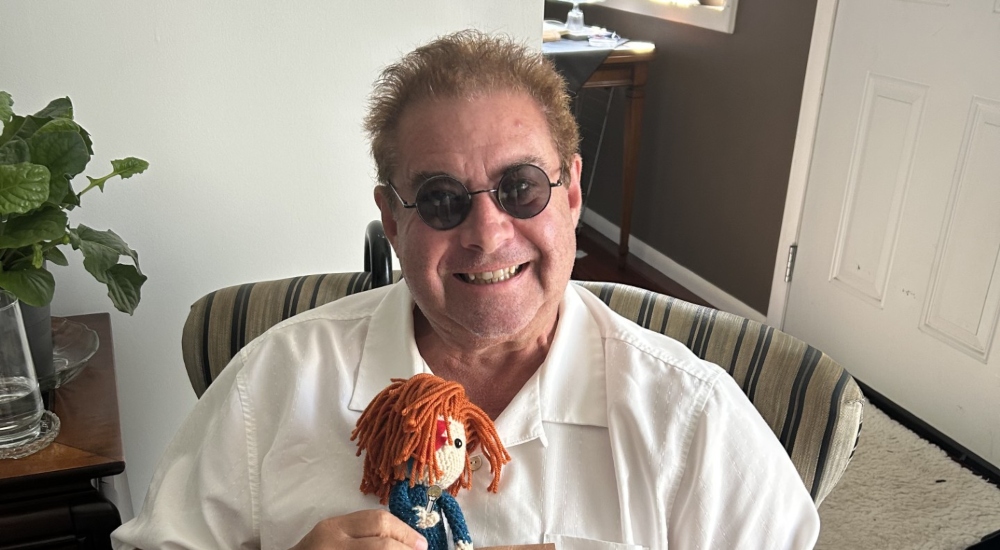

Projects January 21Tom Coffin, Founder of Simply Reliable, Has Passed

In life Coffin dedicated his work and passion to uplifting others, leaving a legacy of compassion both within…

News January 21Sony is Handing Control of its TV Business to TCL

Sony is handing control of its TV and audio business to TCL as major TV manufacturers jockey for…

News January 21Bang & Olufsen to Preview New Landscape Speaker at Integrated Systems Europe 2026

Bang & Olufsen is officially entering the outdoor architectural audio market and will preview a new landscape speaker…

Briefs January 21Meze Audio Unveils STRADA: A New High-End Closed-Back Headphone

Premium closed-back craftsmanship meets innovative driver tech in Meze Audio’s new STRADA headphones.

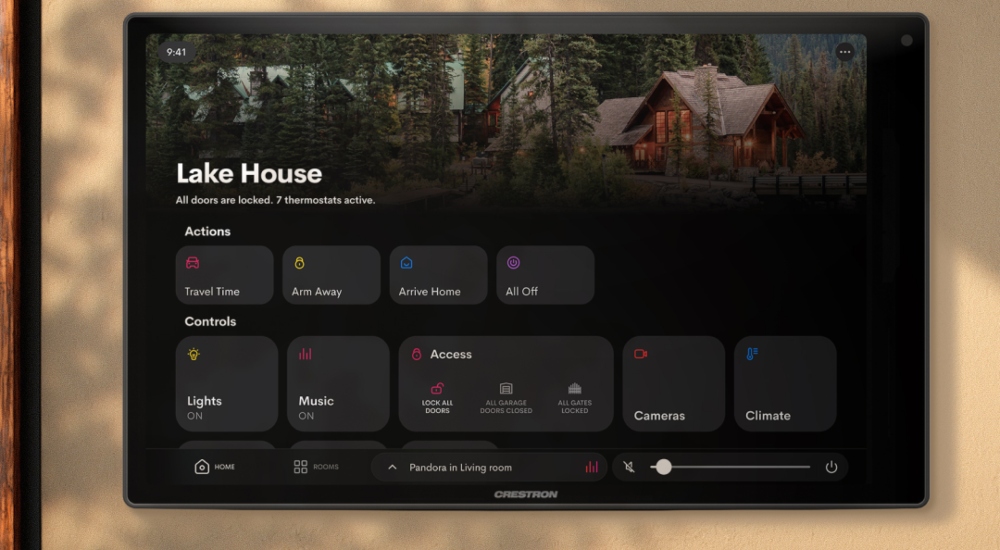

News January 21Crestron Introduces 80 Series Touchscreens for Dedicated Smart Home Control

Crestron’s latest touchscreens blend design, performance and native Crestron Home OS integration in a package meant to be…

News January 20Torus Power Marks 20 Years with Power Isolation Showcase at ISE 2026

Torus Power will celebrate its 20th anniversary at ISE 2026 and show off its toroidal isolation transformers.

Briefs January 20Vicoustic Names Playback Distribution as U.S. and Canadian Distribution Partner

Vicoustic and Playback Distribution partner to expand North American access to acoustic treatment solutions.

News January 20