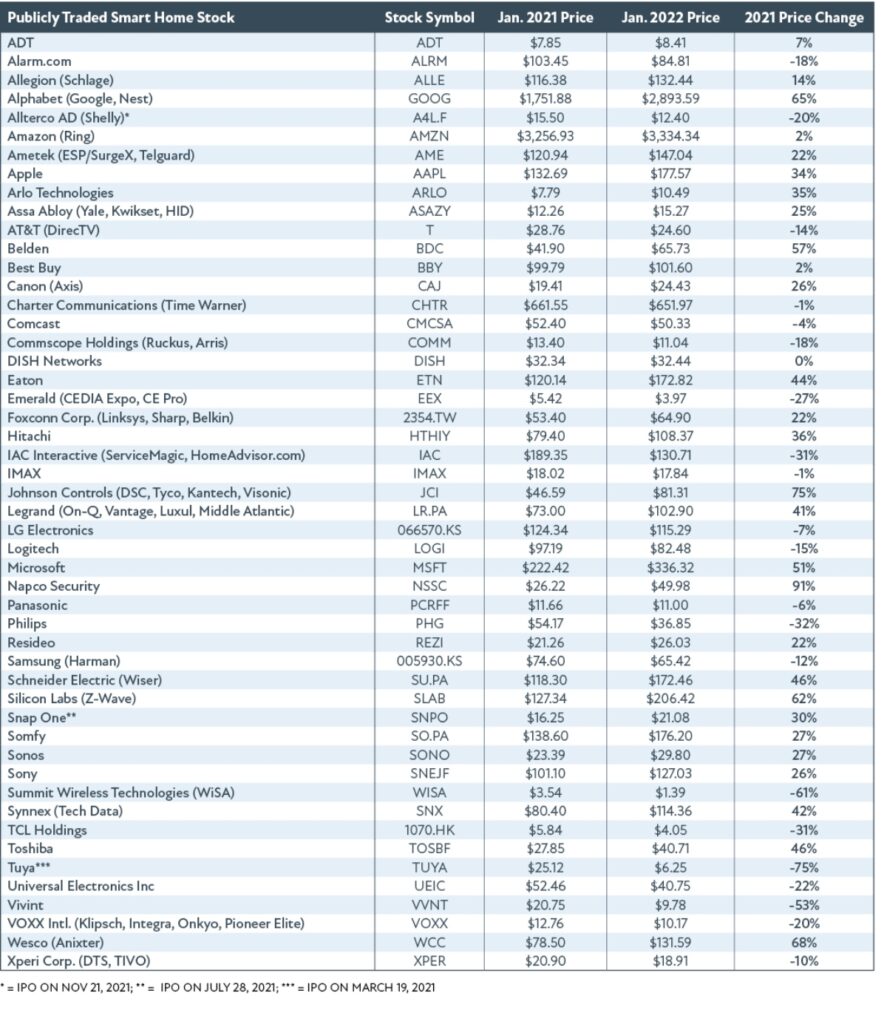

Publicly traded companies engaged in the smart home market finished with another strong year in 2021 in which the average smart home stock price rose a solid 20.1%.

The 2021 growth in the CE Pro Smart Home Stock Index was led primarily by companies engaged in the security space, likely driven up by high demand due to increased crime rates across the nation.

The top smart home stock growth companies were:

- Napco Security (up 91%)

- Johnson Controls, owners of brands such as DSC, Simplex, Tyco, Kantech, Visonic, Exacq, Sensormatic, American Dynamics and others (up 75%)

- Wesco, parent company of distributor Anixter (up 68%)

- Alphabet, parent of Google and Nest (up 65%).

Overall, 30 companies had stock gains in 2021, while 20 saw their stock fall. That is a much more mixed bag than has occurred over the past two year. In 2020, only 16 companies had stock price decreases and in 2019 there were just eight companies with lower share prices.

The 20% smart home stock growth rate in 2021 is on par with the overall stock market. The Dow Jones Industrials rose 18.7% for the year, while the tech-heavy Nasdaq grew 21.4% last year.

The smart home stock index has now risen for three consecutive years. The 2021 gain of 20% was preceded by a 34.5% gain in 2020 and a 19% increase in 2019. The last year smart home stocks fell overall was in 2018 when they were cumulatively down 19%.

The list of publicly held companies is dynamic with some new companies added and others dropped as companies buy into the smart home space, sell their smart home assets or diminish their role in the market. For 2021, the CE Pro Smart Home Stock Index includes 50 companies. Among the additions this year are:

- European brand Allterco Robotics and its Shelly smart home brand were added as the company entered the U.S. market and debuted as a public company in November 2021.

- Security giant Assa Abloy, based in Sweden, and parent of key brands such as HID Corp., August, Life Safety Power, Medeco, Sargent, Securitron and many others, is now being tracked due to its acquisition of smart door lock makers Yale, Kwikset and Baldwin.

- Snap One, makers of 20 market-leading brands in the smart home space from the CE Pro 100 Brand Analysis, went public on July 28. The company saw its stock rise 30% since that IPO.

- Synnex, the nationwide distributor, purchased Tech Data in 2021 to strengthen its position in the pro AV space.

- Tuya, the global IoT platform developer that now has more than 100 million devices worldwide using its framework, debuted as public stock last March.

Among the companies dropped from the list are Office Depot, Qualcomm, Stanley Black & Decker, Intel, DSP and Haier. As always, many of the stock prices (rise or fall) are not necessarily directly reflective of the state of the smart home market. Most of the companies on the list are highly diversified companies engaged in multiple industries, from automotive to commercial security to elevators.

2021 Smart Home Stock Big Winners, Losers

As noted, 30 stocks had price gains in 2021. Of those, 26 had strong double-digit increases. That is down from 32 companies that had growth rates over 10% in 2020.

Napco Security was the biggest gainer last year, almost doubling its stock price from $26.22 per share to $49.98. That gain was on the heels of an 11% decline in Napco’s share price in 2020. Several other companies that had strong gains last year were coming off poor years in 2020. Belden, for example, rose 57% in 2021 but was down 24% the previous year. Canon, owners of Axis Communications and 2N, rose 26% last year after falling 29% in 2020.

On the losing side in 2021, the biggest drop came from Summit Wireless Technologies, makers of the WiSA high-definition wireless audio standard. Last year the stock fell 61% to $1.39 per share. Other companies with big drops in price were Philips (-32%), IAC Interactive, parent of ServiceMagic and HomeAdvisor.com (-31%), and TCL Holdings (-31%).