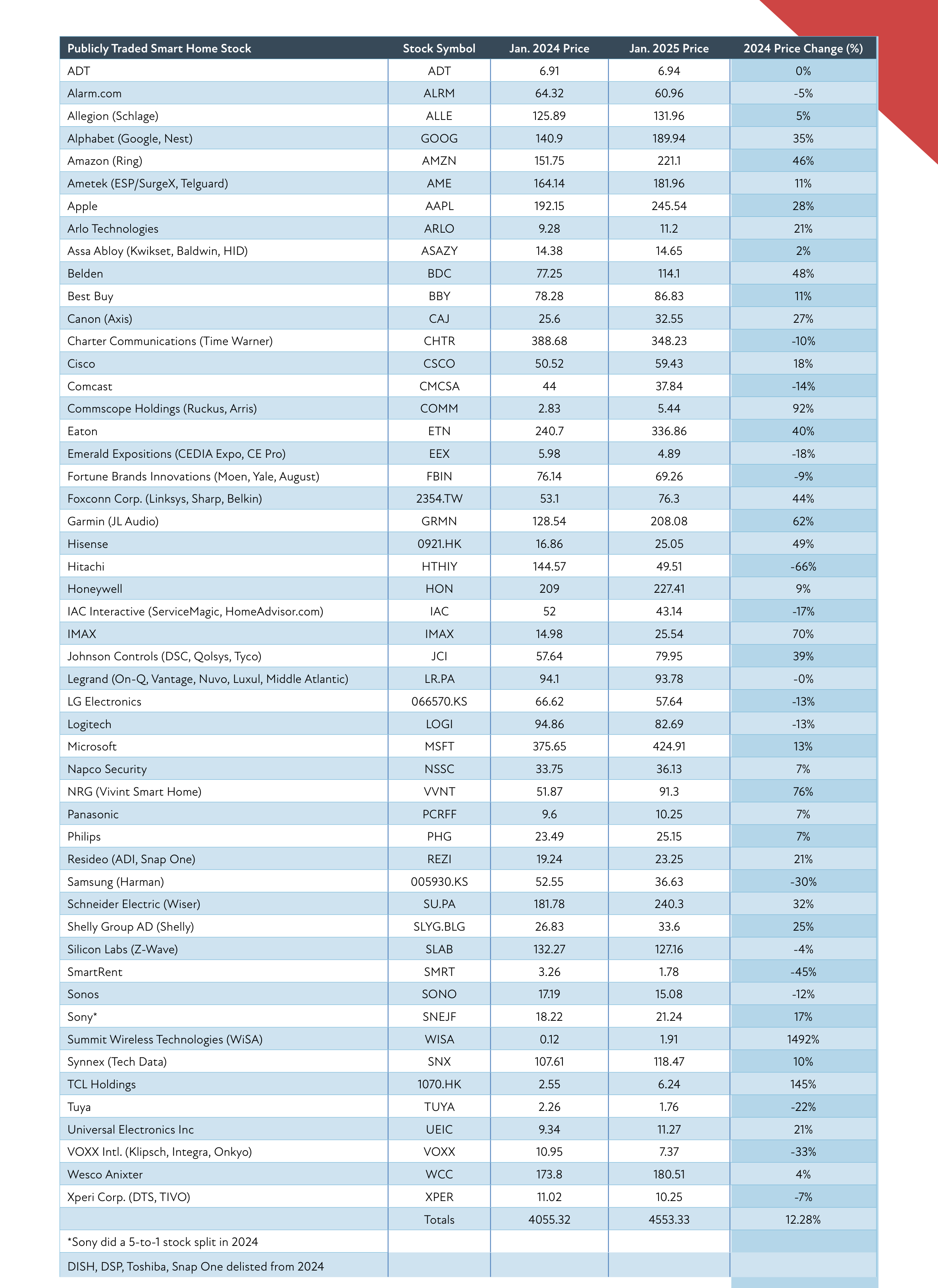

The custom electronics industry keeps humming along providing solid returns for those investing in public companies in the space. As CE Pro tracks every year, the 2025 Smart Home Stock Index report reveals those companies’ increases and declines and last year they rose a combined 12.3%.

It marked another healthy year for the smart home space, one that saw many moves in the M&A space during the busy time for manufacturers, distributors, and integrators.

The 12.3% surge came on the heels of the 2024 Smart Home Stock Index, which experienced a big 26.4% bump following a stellar year for industry investing.

As usual, there were several factors impacting businesses and financial standing last year, but public stocks had an impressive 2024. Between a national presidential election cycle, conflicts in Europe and the Middle East, inflation on the home front, and more, the S&P 500 still rose 23% to enjoy back-to-back increases of 20+ points.

In that regard, the custom integration channel fell off the national pace after ticking a few points ahead in 2023.

2025 Smart Home Stock Index Big Winners

Out of the 55 companies tracked in 2024 (four were delisted and not counted toward this year’s overall year-over-year change), 36 had stock prices that increased or stayed flat.

Of those, the biggest gains came from the security space and makers of surveillance cameras, smart locks, alarm panels, video doorbells, etc.

Winners in that area include Johnson Controls (+39%), Axis Communications (Canon, +27%), Arlo (+21%), Resideo (+21%), Honeywell (+9%), Napco Security (+7%), Allegion (+5%), and Ring, whose behemoth owner Amazon rose 46%. Assa Abloy and ADT stocks were essentially flat in 2024.

Resideo certainly benefitted from its acquisition of Snap One in 2024, bolstering a distribution channel that already was home to its ADI brand. Snap One’s vast stable of brands adds a variety of technology opportunities for their dealers; at the same time, the company was delisted from being a public company (its stocks were purchases for $10.75/share).

Additionally, Google’s parent company, Alphabet, and Apple both had decent years, rising 35% and 28%, respectively.

Energy Category Continues to Trend Upward

Another group with solid returns within the industry last year was from the energy contingent.

The stock price for NRG, the energy giant that acquired Vivint Smart Home in 2023, soared 76%, and Eaton (+40%), Schneider Electric (+32%), and SurgeX parent Ametek (+11%) all fared well in 2024.

Energy and power management, battery storage, alternative energy sources, and other solutions have become so in-demand that the annual Lightapalooza has incorporated the exhibitors and education sessions around the category.

Networking Companies Make Solid Gains

Other companies whose stocks made solid gains in 2024 included those in the networking field, which also should come as no surprise.

Commscope (Ruckus, Arris) shot up 92% to $5.44 while Foxcomm (Linksys, Sharp, Belkin) increased 44% from $53.10 to $76.30.

It’s Not All Sunshine, However

On the flip side, Hitachi (-66%), SmartRent (-45%), VOXX Intl. (-33%), and Samsung (-30%) represented the largest declines in 2024.

CE Pro and CEDIA Expo owner Emerald’s stock dipped 18% from $5.98 to $4.89.

Now that we’re midway through January, let’s see how the remainder of 2025 shapes up and if it will be another strong year for M&A activity and investment overall.

CE Pro Senior Editor Zachary Comeau contributed to this article.