Whether or not you change your solutions portfolio or add more services, those moves provide only a partial method of improving your business’ bottom line. However, the biggest investment integrators may make to achieve that goal is streamlining their business software, according to recent data from the CE Pro Business Resources Deep Dive.

Not only can exploring and selecting the right software increase efficiencies throughout an organization’s business processes, it can help ensure finances are more easily scrutinized, projects stick to their timelines, technicians are being used to their fullest capacity, and much more.

Every little detail matters when it comes to profits, but dealers may be “leaving money on the table” within their own integration companies if they aren’t maintaining a robust software solution.

These days, that may incorporate a combination of purpose-built pieces for accounting, inventory, proposals, etc., or perhaps an end-to-end solution that addresses every phase of a project as well as internal administrative duties. Some dealers’ teams even end up developing their own software platforms to tackle all of those types of business concerns.

In the latest CE Pro Business Resources Deep Dive research, key takeaways include respondents indicating greater revenues, more usage of end-to-end software systems, embracing cloud-based solutions, and looking for reliable support/customer service from their suppliers.

Industry Software Implementation Evolves

The breakdown of integrator survey-takers essentially can be split into two sizes — roughly half are one-man shops or companies of 2-10 employees; and half are larger-scale dealers with 11 or more team members.

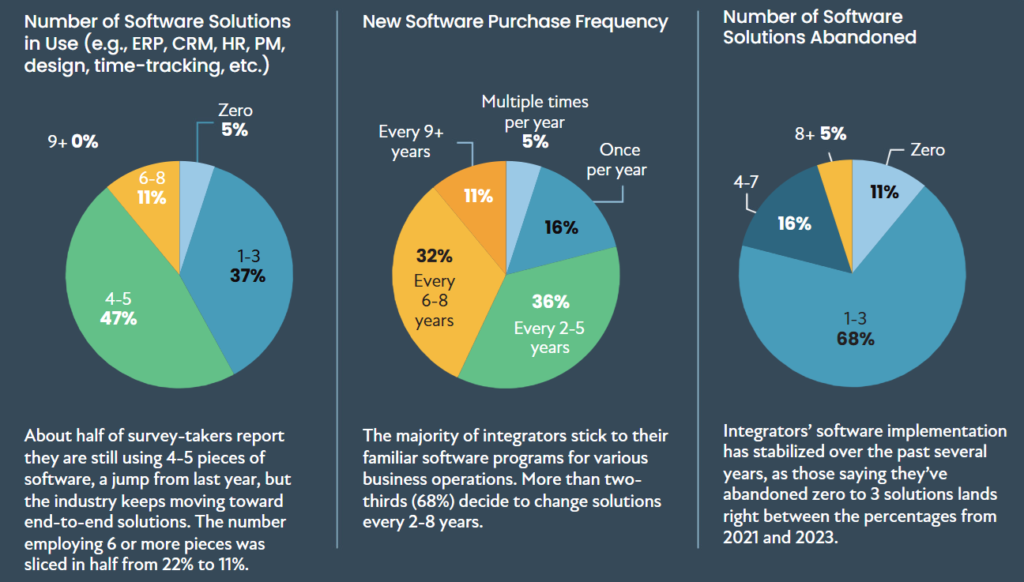

When it comes to the number of software programs dealers implement, about half of this year’s survey-takers (47%) report they are still using 4-5 pieces of software, a jump of 16% from last year.

But the industry keeps moving toward end-to-end solutions, or at least fewer solutions. The number of integrators employing 6-12 pieces was sliced in half from 22% to 11%.

Only 5% of integrators do not use business software, which is status quo from our 2023 report. The median number of software pieces respondents used is four.

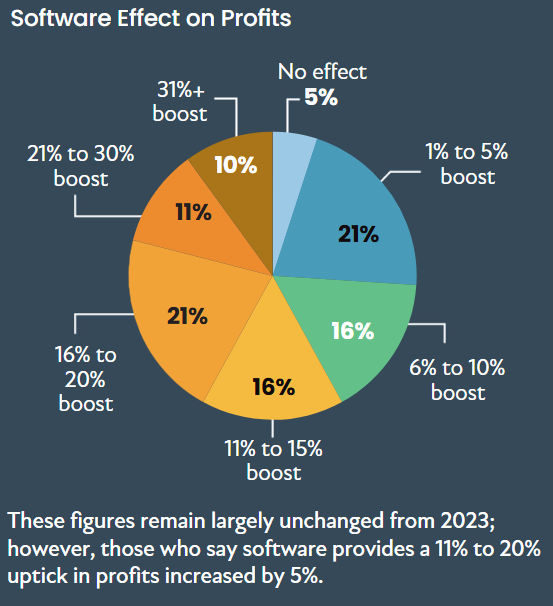

From that, dealers report earning more profits. The number of CE pros reporting 1%-5% increases in profits grew 4% from our 2023 Business Resources Deep Dive, while those who say software provides an 11% to 20% uptick in profits surged by 5%.

Median increase in profits thanks to software impact is 13%, according to the survey.

The majority of integrators stick to their familiar software programs for various business operations. More than two-thirds (69%) decide to change solutions every 2-8 years — about one-third vetting new pieces every 2-5 years and one-third doing so every 6-8 years.

Still, integrators appear to be underscoring that industry software specialists are developing and deploying really solid software solutions. The number of respondents saying they switch to new software only once or twice per year dropped in half from 43% to 21% since 2023.

How Dealers Select Business Software

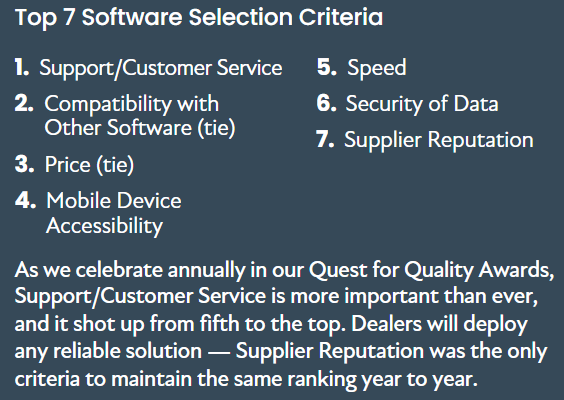

Just like we celebrate annually in our Quest for Quality Awards, Support/Customer Service is more important than ever when it comes to choosing the most compatible software for dealers’ needs. When asked about the most important business resource attributes, that answer shot up from fifth to the top of this year’s list.

That said, dealers aren’t too picky about selecting particular supplier’s software as long as it’s reliable — Supplier Reputation was the only criteria of this year’s top 7 to maintain the same ranking year to year and it’s at the bottom of the list.

Meanwhile, Compatibility with Other Software and Price were tied for the next most desired features. Price ticked up one spot from No. 4 a year ago, indicating that inflation remains a very influential part of vetting and implementing platforms.

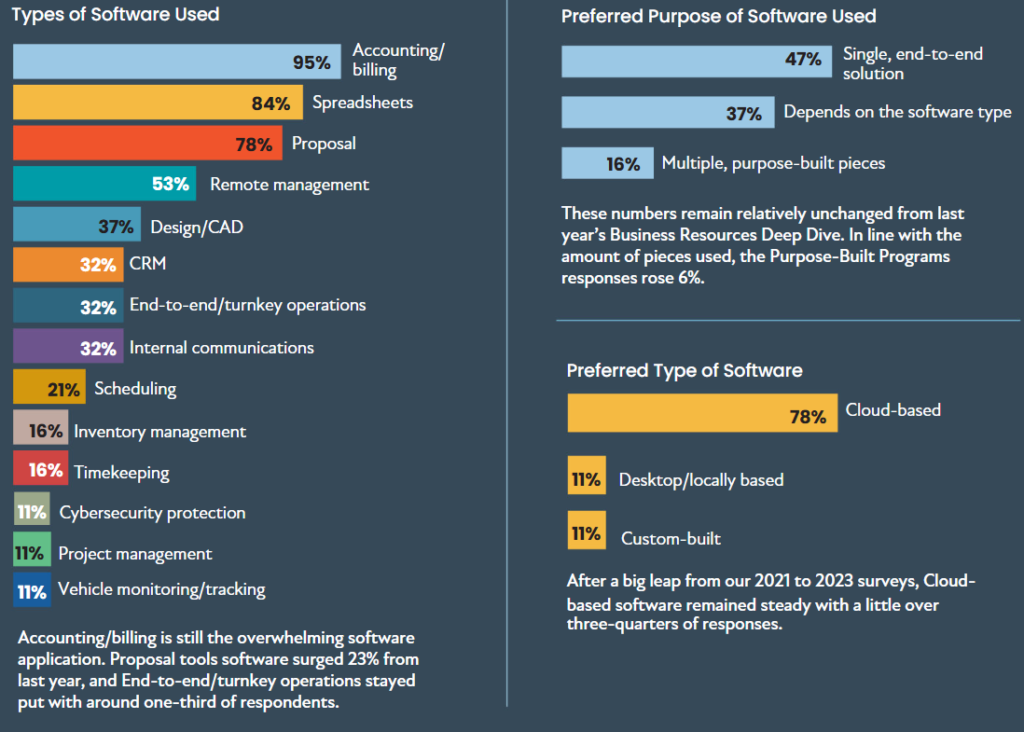

While features wanted in software solutions/suppliers saw some swings from our 2023 report, the list of popular functionalities and use cases remain relatively unchanged from CE Pro’s 2023 Business Resources Deep Dive.

In line with the amount of pieces dealers say they use, preferred scenarios of software implementation included a 6% uptick to 16% for Purpose-Built Programs responses. Single, End-to-end solutions are notably preferred by nearly half of respondents (47%), however.

After a big leap from our 2021 to 2023 surveys, Cloud-based software stays steady with a little over three-quarters of survey-takers shifting their business processes to those platforms.

Software Applications & Reasons for Dropping Solutions

Accounting/billing is still the overwhelming software application. Proposal tools software surged 23% from last year, and End-to-end/turnkey operations stayed put with around one-third of respondents as far as the most common functions.

As far as ditching software that they’ve used and decided it does not work for their business, integrators’ software implementation has stabilized over the past several years.

Those saying they’ve abandoned zero to 3 solutions lands right between the percentages from 2021 and 2023. That number stands at 68% for this year’s survey, likely in correlation to satisfaction of dealers’ already installed software.

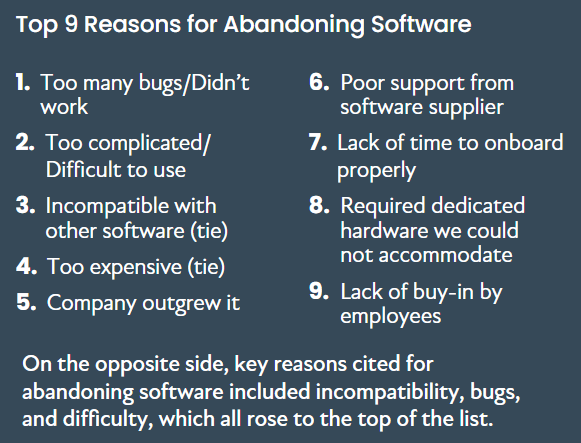

Mirroring what dealers pointed to as key criteria to purchasing software, incompatibility, bugs, and difficulty ranked at the top of criteria for abandoning software.

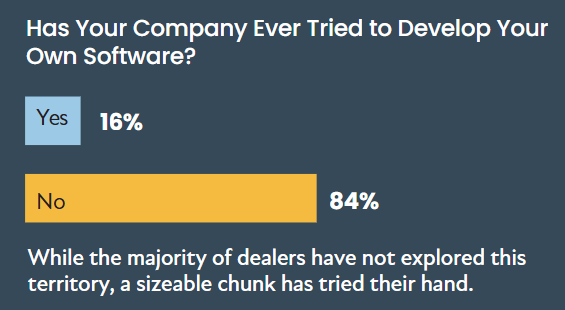

While the majority of dealers have not explored developing their own software solution, a sizeable chunk has tried their hand and had success. About 15% of integrators have used their technical know-how to figure out what criteria fits best for their companies and constructed software to match.

Companies such as Creative Sound & Integration and Sight & Sound Systems are two that have evolved to add software products among their contributions to the industry. They were the practical minds behind ProjX360 and MaxaWare, respectively.

And other software providers continue to upgrade their platforms on a regular basis, giving integrators more of what they are asking for in a solution, whether it’s purpose-built or end-to-end. A great example is Portal.io, which has figured out how to use AI in their new Proposal Builder tool to speed up that process dramatically.

With all of the innovation in this industry, we can’t wait to see what else is in development as we speak.

Commercial & Security Dealers’ Software Trends

CE Pro sister publication Commercial Integrator + Security Sales & Integration’s companion Business Resources Deep Dive, appearing in their Nov./Dec. issue, weaves together in-depth interviews with four prominent commercial integrators who reflect on the software tools they use and how those tools boost their business. CI+SSI recruited Bill Fons of CTI, Heather Sidorowicz of Southtown Audio Video, Brad Kirby of Sweetwater Integration, and Dalton Parker of TVS Pro to participate in the piece.

Fons analogizes integrator business operations to flying an airplane: When you’re small, it’s akin to a single-engine plane that can be flown on Visual Flight Rules; when you get larger, however, more sophisticated instrument panels are required. For integration businesses, a great ERP or similar platform can be foundational to scaling sustainably. In the piece, Sidorowicz discusses her success with D-Tools, Kirby recounts the benefits of utilizing Solutions360’s ERP software and Parker speaks positively about deploying Zoho One across TVS Pro.

The article shares interviewees’ perspectives on how they select a particular software solution, how suppliers can pass “the vet” they’re put through, and whether single-purpose software or end-to-end solutions are more preferable. Plus, they broach the subject of AI and whether its use potentially hampers the “human touch” that underlies integrators’ client relationships.

In addition, CI+SSI shares exclusive data from a survey of its integrator readership, examining questions like how integrators rank the importance of various criteria when selecting business resource software. The three highest-ranked considerations were security of data, compatibility with other software and price.

Another ranking question centers on how these software tools help businesses like yours. The three highest-ranked benefits were the ability to improve/define your business processes, the ability to install projects faster and more efficient billing.