What a difference a year makes! Last year’s CE Pro Wage & Salary Study revealed that overall wages in the custom electronics industry were flat in 2020 as integration companies paused as they waited to see the effects of the pandemic. But 2021 is a completely different story. The so-called “Great Resignation” coupled with rising inflation and high demand for custom installation services has resulted in a spike in payroll for certain positions as high as 15%.

Across the board, dealers had to pay more in 2021 for project managers, sales staff, programmers, systems designers, installation and service technicians, IT specialists, and even office admin support staff. At the same time, there was a slight increase in certain key benefits such as health insurance that integration companies provide to their employees, ostensibly a necessary boost to attract workers.

But don’t feel sorry for integration company owners — at the same time they were forced to pay higher wages to staff, company executives were taking in the highest percentage increase of all. According to the study, the biggest victors in terms of wages in 2021 were integration company owners, presidents, CEOs, general managers, COOs and vice presidents who saw their own salaries rise by a whopping 27% last year.

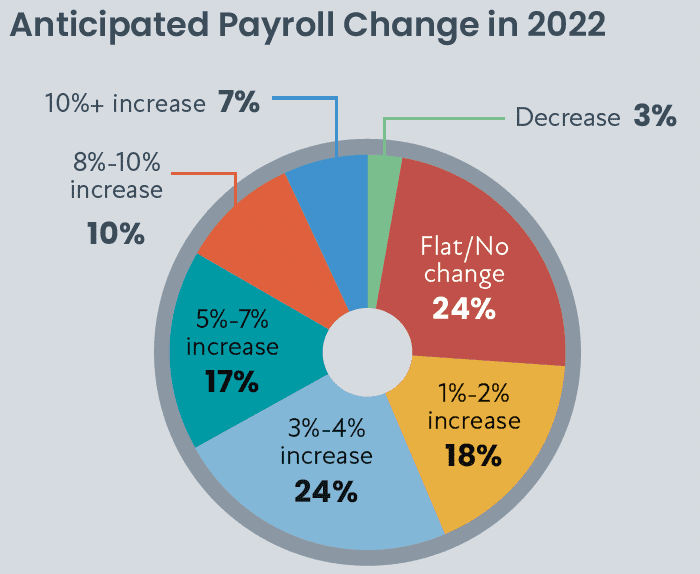

Heading into 2022, integrators expect an average overall payroll increase of just 4%, which might be an optimistic outlook given that the latest data from the U.S. Bureau of Labor Statistics reveals an inflation rate of 6.8%, the highest rate since 1982.

Of course, we all know that the owner’s compensation ebbs and flows with the success of the business. During 2020 in the midst of the initial COVID-19 outbreak in which many businesses were shut down and many owners were forced to lean on business loans such as the Paycheck Protection Program, the average compensation for integration company executives fell 15%, so the 2021 increase is well deserved.

Among the company owners who responded to the survey, 76% percent reported they draw a salary from their own company; 47% derive their compensation from a combination of a directly salary plus company profits. Only about one-in four of company owners (24%) do not pay themselves a salary.

Meanwhile, heading into 2022, integrators expect an average overall payroll increase of just 4%, which might be an optimistic outlook given that the latest data from the U.S. Bureau of Labor Statistics reveals an inflation rate of 6.8%, the highest rate since 1982.

Techs, Other Key Roles See Pay Bumps

The 2022 CE Pro Wage & Salary Study was conducted in November and December 2021 with 268 total respondents across North America. The study covers wages, benefits, bonus compensation, labor profitability and more

The increase in wages is most apparent at the technician level, where the average hourly wage for an entry-level technician in 2021 rose by $1.28 per hour nationally from $18.58/hour to $19.86. That increase represents a 7% hike. Compare that to 2020, when the average hourly wage for an entry-level technician rose by just 13 cents.

But finding experienced technicians has become a major pain point. In 2021, the average national hourly wage for an installation technician with more than two years of experience rose a staggering 15%, from $23.09/hour in 2020 to $26.47/hour last year. Service technician wages also rose, to $25.71/hour, a 6% increase.

Other key positions that saw increases in the national average are project managers (up 7% to $71,186), programmers (up 6% to $68,206), IT/network specialists (up 7% to $66,878), sales managers (up 7% $88,898), and inventory managers/office managers (up 4% to $21.04/hour).

Digging deeper, only 3% of integrators reported they lowered payroll in 2021. That is compared to 9% of dealers who decreased total payroll in 2020, the first year of the pandemic when some integration businesses were shut down for a period of time during the initial lockdown phase in certain major metros.

In 2021, the companies that lowered payroll were likely those that had a hard time finding replacement personnel to fill open positions, or perhaps they were smaller integration companies that had cut back their employee numbers during the first stages of the pandemic and realized they preferred having a smaller team.

Assessing Sales Compensation, Bonuses & Benefits

On the sales side, CE pros report an array of ways they pay their sales teams. Most (57%) pay a combination of salary plus commission. The average commission rate is 6.6%. Less than one-in-four integration companies (23%) pay base salary only, while only 10% pay their sales team solely via commission. In many cases the company owners themselves handle all sales transactions and therefore they have zero sales commission payouts.

Commissions are paid to sales staffs in various ways and times. There really is no dominant methodology in place in the industry for when to pay commissions. Throughout the life cycle of the project and at the time of project completion are the most common times. Other companies pay commissions strictly on a calendar basis, while still others pay at the moment the contract is signed and the deposit is collected.

When times are good, it’s a great tactic to share the wealth with your team, and that is exactly what 72% of integrators do by offering bonuses. The median bonus payout in 2021 was $847 per employee, that is 30% higher than the median bonus of $650 in 2020.

Lastly, benefits have become an increasingly important element of company culture that helps attract and retain new employees. According to the survey, the percentage of integrators that boosted their offerings for health insurance (employee only and family) and dental insurance rose in 2021. Product discounts offered to employees is another benefit that saw more integrators offering it last year.

Lower margin on labor continues to be an increasingly sour note for the industry. According to the survey, integrators report earning 28.1% profit on their labor. That is down slightly from 28.4% in 2020, but significantly down from the much healthier 36.9% in 2019.

This continuing trend could be a signal that the price pressures related to DIY devices that are flooding the smart home scene are continuing to force some CE pros to lower or maintain their hourly rates for clients to remain competitive.

Remarkably, 2% of integrators report they lose money on their labor. Those are likely security-based providers offering subsidized entry-level alarm systems with additional smart home features tacked on and multi-year monitoring agreements. Another 7% of dealers report they break even on their labor.

The use of subcontract labor fell in 2021. According to the study, 36% of integrators report they used subcontract installation labor last year. That is down from 46% in 2020. It could be a sign that integrators are opting to use their own staff more for pre-wires and other installation tasks perhaps driven by the pandemic and the lack of a skilled independent labor pool.