Residences and apartments are getting a smart home makeover from the lobby to the traditional front gate of a multifamily (or multi-dwelling unit, MDU) property. Once purely the domain of the standalone homes, MDUs are metamorphosizing themselves with better security, heightened convenience, and intelligent home automation that satisfy developers, builders, property managers and homeowners around the world.

Not strictly confined to the United States, this phenomenon capitalizes on the global growth and homeowner appeal of high-rise condos, apartments, and projects with multifamily residences.

The smart home’s embrace of wireless capability is helping property and building managers differentiate their developments by offering energy-saving comfort, improved convenience, and peace of mind security. While this trend has undoubtedly happened with new construction, legacy MDUs are being upgraded to provide residents with these new capabilities.

Parks Associates estimates that 30% (36 million households) of U.S. broadband households live in MDUs, 66% (79.5 million households) live in single-family homes and 4% (4.8 million households) report other kinds of accommodations.

MDU-specific solutions generally support properties of any size, from just a small number of residences to scores of units, connecting individual dwellings to the outside gate or entry door and the lobby vestibule area.

These solutions provide property-wide video intercom communications, energy management, tight integration with lobby doors, connection to Session Initiation Protocol (SIP)-based phones, doorkeeper services, and complete smart home offerings for individual residential units.

Companies are making significant investments in these platforms, as demonstrated by leader RealPage, which acquired Stratis IoT in August 2020 in a deal estimated to be between $15 million and $40 million.

Efficiency enhancements have proven to be a strong lure for today’s renters. MDUs now have automated gates and garages that be remotely monitored (on and off the property) and even receive notifications when an event triggers immediate attention. (e.g., pizza delivery).

In addition to being a powerful selling feature, property owners find this capability intriguing as it optimizes acreage efficiency since a single system can manage many units at once.

With the rise of smartphones over the past 14 years, touchscreen technology has become the preferred interface for a wide range of products, appliances, and solutions in the home. At the MDU level, homeowners are taking advantage of one-touch access to property amenities and concierge services.

Moreover, renters can safely interact with guests and building employees directly from their residential units. This usage model has become an essential feature for many individuals with pandemic-driven concerns about strangers entering their unit.

Like a standalone smart home, individual residences can be “personalized” and automated with intelligent lighting, smart climate control, smart doorbells, locks and entertainment. Some of the more advanced solutions comprehend popular voice assistant functionality like Google Assistant or Amazon Alexa.

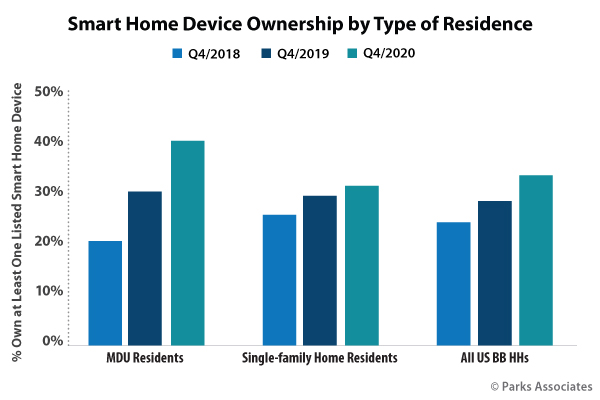

Parks Associates follows the MDU category closely and has observed several interesting insights about this market. First, the research firm shows that 43% of MDU residents owned smart home devices in 2020, compared to 30% in 2019.

Because tracking smart device data on heating and cooling can help property managers identify inefficient and wasteful HVAC equipment, property managers are highly motivated to leverage smart devices like smart thermostats, lights, and outlets to utilize energy more cost-effectively.

The importance of the smart home category and how it’s influencing the MDU market cannot be underestimated. Recent Parks Associates findings report that 40% of MDU renters are interested in “bulk” Internet service bundled with their rent. Parks Associates also found that 41% of all MDU broadband households owning at least one smart home device, compared to 34% of single-family households.

Interestingly, smart home device adoption among MDU residents correlates with age, as consumers in the 25- to 34-years-old age bracket are among those more likely to embrace smart home devices and the most likely to live in a multi-dwelling unit.

Unquestionably, this data underscores that today’s homes are dependent now, more than ever before, on connectivity and technology. MDU developers and builders recognize that this trend has been ongoing for several years. ADT Multifamily and Tuya Smart are just two companies looking to leverage the $1.9 billion in annual incremental rental and services revenue that Parks Research expects to be generated by MDU-based smart home capabilities.

From a practical business standpoint, the operational efficiencies, competitive differentiation advantages, and lifestyle enhancement potential for renters are simply too significant to ignore. The urbanization of the smart home is here to stay.

Mark Vena is Senior Director, Smart Home Research Practice, for Dallas-based Parks Associates.

Editor’s Note: CE Pro’s sister publication Security Sales & Integration originally published this article, and has partnered with Parks Associates for the creation of DIY FYI, a column designed to help dealers keep track of important smart home market developments, what the competition is and whether they want to jump into something they see as a new opportunity.