It appears the pandemic-led surge in the home entertainment market has leveled off for integrators as they assess the state of their cinema installation business in 2023. Indeed, integrators are predicting a miniscule 0.8% increase in their home theater work for the rest of this year, down from a 7.25% predicted growth rate heading into 2022. If you want to do the math, that represents a drop in demand of more than 1,100% in just one year.

Meanwhile, the demand for high-performance home cinema technology in a multipurpose or great room is outpacing the interest in dedicated home theaters, hearkening the renewal of a home entertainment market trend that started well before COVID-19 came upon the scene.

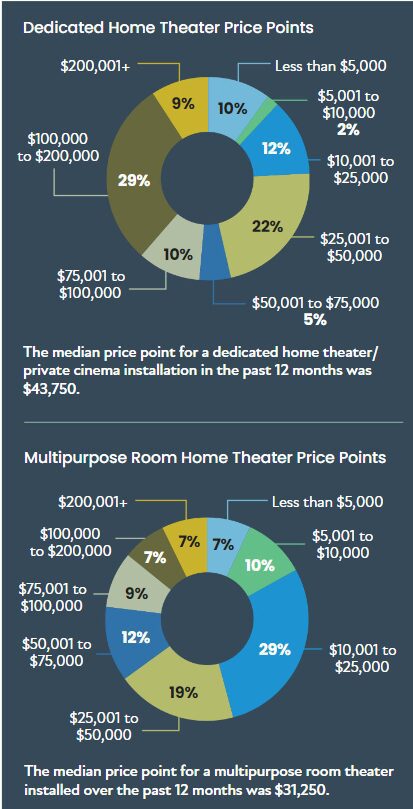

That changing demand is reflected in the wavering of the price points dealers are able to obtain for their home theater design and installation. Specifically, the median price for a dedicated home theater fell by 13% to $43,750 in 2023. On the flip side, the median price for a multipurpose room theater increased by 14% to $31,250.

Those are just some of the datapoints revealed in the 2023 CE Pro Home Entertainment Deep Dive Study, which aims to gauge the state of the home cinema market among professional integrators. The information is meant to help CE pros determine the resources they need to fulfill their clients’ home theater needs while at the same time provide some benchmark data.

2023’s Home Entertainment Market by the Numbers

CE Pro uses the same definition for “home theater” that is used by both the Consumer Technology Association and the National Association of Home Builders in their annual joint State of the Builder Technology Market Study, which is a dedicated home entertainment space with a “minimum 42-inch display with surround sound.”

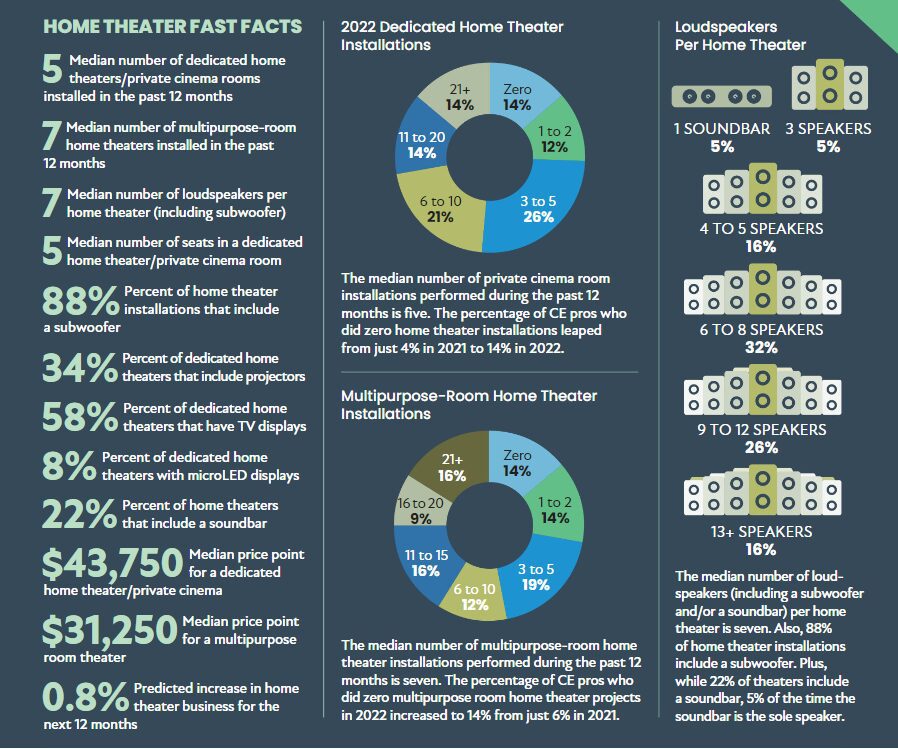

While there appears to be a lull in the super-strong momentum for home theater, the category is still overall on the rebound from where pundits saw it pre-pandemic. Dealers report installing a median of five dedicated theaters in 2022 and seven great-room theaters. That is two more than they reported in 2021. Many commercial theaters that shuttered during COVID-19 are still closed and are not reopening (my town being a great example).

For consumers, having a nice space to watch movies, play video games or binge-watch TV shows is still important.

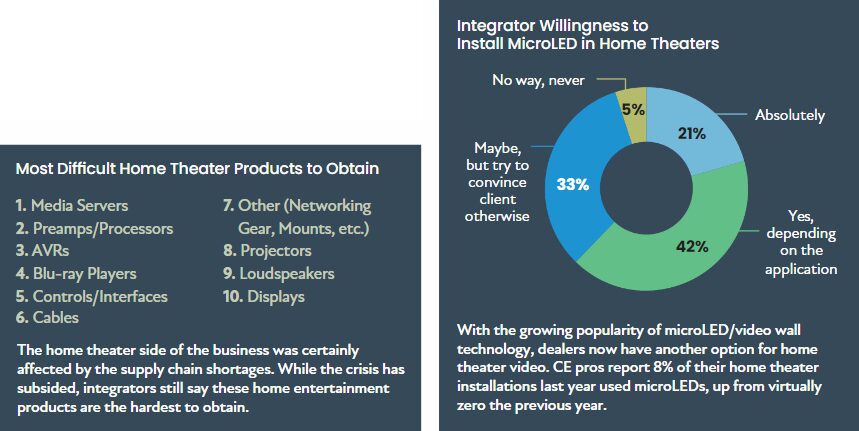

Like many categories of equipment, the home theater category was bitten by the supply chain shortage. The category was especially susceptible to the supply chain crisis because there are so many individual components necessary to complete a professionally installed home entertainment system.

Projectors, displays, AV receivers, Blu-ray players, amplifiers, preamps/processors, streaming media servers, active speakers with digital-to-analog conversion/built-in amplification are just some of the home theater components that were held hostage last year by the microchip shortage.

But the supply chain crisis has since subsided in the home entertainment market. When asked in this year’s survey, integrators reported they are no longer facing difficulty getting products. For comparison, last year’s survey respondents said they could have completed an additional four more home theater projects if they had the gear.

Looking closely at the price points CE pros were able to garner for their home theaters, the dollar figures need to be examined beyond just a one-year trend. For dedicated theaters, which can include basements in some cases, the median end-user price charged in 2022 fell by 13% to $43,750.

That is down from $50,357 in 2021 at the height of pandemic-driven demand. But when you go back to the pre-pandemic price points, the 2022 median price is still a healthy increase of 54% over the $28,277 median number of 2020 — back when the category was seen as bygone as a 1980s heavy-metal hair band.

But then came COVID-19. Home theaters migrated from being “nice-to-have” luxuries to almost necessities for consumers trapped in their homes seeking some solace for their mental health. Perhaps for the first time ever, the desire for a home theater was not merely a luxury amenity sought after only by the wealthy and the elite, but a fundamental imperative that helped consumers maintain some semblance of sanity in an insane situation.

And that thirst for home entertainment was further assisted by the coinciding available income that many consumers suddenly had as they could no longer spend money on travel and dining out.

At the same time, the multipurpose room theater price point has continued to rise, showing that pervasive the trend is for family-wide entertainment in the main room of the house. As noted, the price point for a great room/den/multipurpose room theater is a solid $31,250, up from $27,500 the prior year and up from just $17,312 back in 2020.

When you add up the median prices with the median number of installations, it represents an impressive revenue driver for the typical integrator. Five dedicated theaters at $43,750 each add up to $218,750 in revenue. Meanwhile, seven multipurpose room theaters at $31,250 each are an identical $218,750. In all, it means the home theater business brought in $437,500 for the typical CE pro in 2022.

The technology advancements in home theater enable dealers to offer theater projects at all price points. Approximately 7% of installations were less than $5,000. On the flip side, 7% were more than $200,000.

Several of the same market trends that enable integrators to charge higher prices for home theaters are still in place in 2023. Notably, most integrators have raised their labor rates due to the pressures of inflation that began hitting the economy in the spring of 2020. Since inflation is an everyday challenge for consumers with food, gasoline and other services, it greases the skids for integrators to boost their rates.

According to the most recent CE Pro 2023 Wage, Salary & Labor Rates Study, the average nationwide hourly labor rate charged by integrators is $106.67. That is up 11% from 2020 when the average labor rate was $95.98 per hour.

Of course, the lack of manpower in the industry is continuing to allow dealers to be extremely selective in the projects they choose. Logically, it makes the most business sense to choose larger, presumably more profitably projects.

But, as noted earlier, CE pros are not anticipating flatness over the next 12 months. The tiny predicted growth rate of just 0.8% is even more shocking because integrators tend to be an overly optimistic bunch. It will be interesting to see if their prognostications are correct.

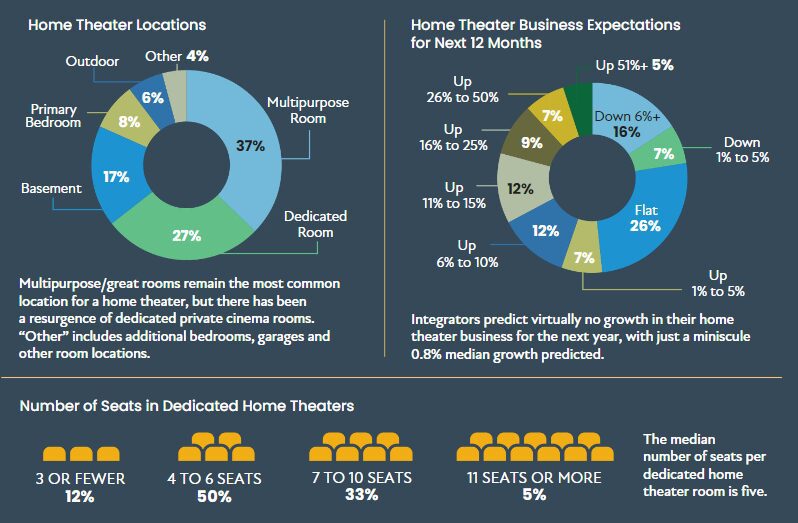

But not all dealers are anticipating a market dip for home theaters. According to the survey, 23% of dealers believe their business will be down, while 26% say it will be flat. That means 51% of dealers still believe their home theater business will grow this year.

Another indicator of the leveling off of the market can be seen by the fact that 14% of respondents indicated they did not install a single home theater — either in a dedicated space or in great room — in 2022. That is up from just 8% who did not do any home theater business in 2021.

MicroLED Trend Growing

Another interesting trend is the advent of microLED video walls as home theaters. CE Pro documented the trend in its December 2022 edition with a profile story of Architech Designs in New York City replacing noted music producer Clive Davis’ projector-based home theater with a giant Samsung microLED.

According to the Deep Dive survey, 95% of integrators are willing to use a microLED as the basis for a dedicated home theater, despite the fact that a video wall can create limitations in terms of speaker placement for audio. More than one in five (21%) says they would absolutely install a video wall in a dedicated room, while 42% say they would do it if the application called for it. Another 33% of integrators say would install a microLED home theater, but would try to convince the clients to go with projection first.

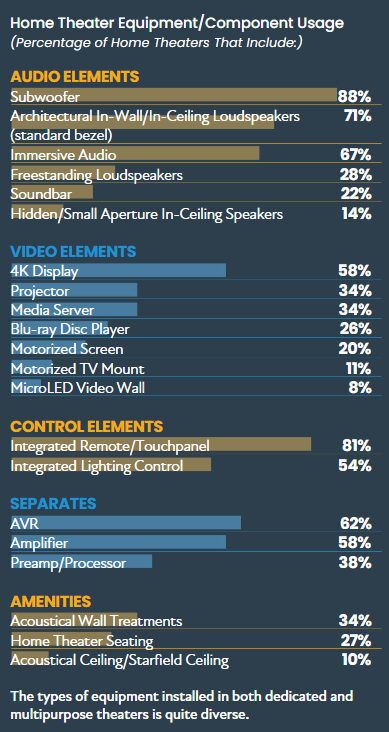

According to the survey, last year 58% of home theaters utilized traditional 4K TVs as the central video component, while 34% used projectors. MicroLED video walls accounted for 8% of installations last year. That is up from virtually zero in 2021.

Some other equipment trends of note include:

- 71% of theaters use architectural speakers, while 14% of the time those being small aperture or invisible speakers

- 39% of theaters use freestanding speakers

- Only 20% of theaters use a motorized screen, while 11% had a motorized mount

- 26% of installations still include a Blu-ray disc player, and 34% had a media server, showing that physical media is not dead

- In 27% of theater installations, dealers are also able to sell home theater seating

As noted, the supply chain problems have subsided mostly, but dealers still offered a list of home theater gear that has been somewhat hard to obtain. Not surprisingly, microchip-based products such as media servers, preamps/processors, and AVRs top the list.

In terms of the average size of home theaters, there has been no change from last year. The average number of loudspeakers (including a soundbar and subwoofers if applicable) remains seven. The average number of seats per theater is five.

With the technology today, integrators can install a home theater in just about any room in the house the client wants. Multipurpose room/great room/den is the most common location, with 37% of installations in that open-concept area. The private cinema room accounts for 27% of projects, while 17% are in basements, 8% in primary bedrooms, 6% outdoors and 4% in a secondary bedroom.

Nearly one-in-three home theater installations last year incorporated the home theater audio/video as a single zone in a multiroom AV distribution system. That application would obviously be most popular in great room and outdoor applications in which the homeowner might be moving throughout the home.

In terms of what integrators are looking for to boost their home theater business, the performance of audio and video within the components are the highest priorities.

According to respondents, audio quality and video quality are by far the most important elements, followed by equipment reliability, then manufacturer support. Price is well down on the list of priorities with equipment availability, margin, and aesthetics of the gear listed as more important than the price point.

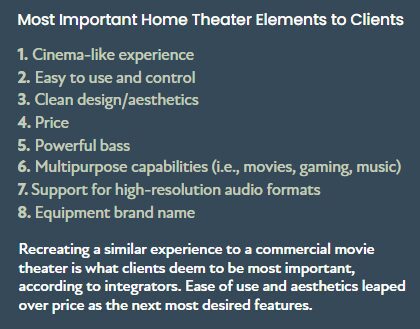

Meanwhile, integrators say their clients are most focused on the experience. Similar to the past two years, when asked what their clients desired most in a home theater, dealers said customers want a cinema-like experience first. That is followed by ease of use, aesthetically pleasing design, and price. Powerful bass “you can feel” is listed another priority, along with the ability to use the theater for other experiences besides just watching movies, such as playing video games and listening to music.