The Latest

Filter by Topic

Filter by Type

New Wave of Online Attacks Puts Connected Home Devices at Risk

Attacks tied to a new vulnerability are targeting a wide range of connected home devices, highlighting need for…

News December 9Time Is Running Out: CEDIA Expo/CIX PitchFest Debuts Next Week With $1,200 in Savings and Breakout New Brands

Commercial Integrator, CE Pro and CEDIA Expo/CIX are continuing final preparations for next week’s two-day webinar event: CEDIA Expo/CIX PitchFest: New…

News December 9DCC Technology Rebrands as Nexora

The new Nexora identity reflects collaboration, growth, and a focus on specialist markets across 27 businesses.

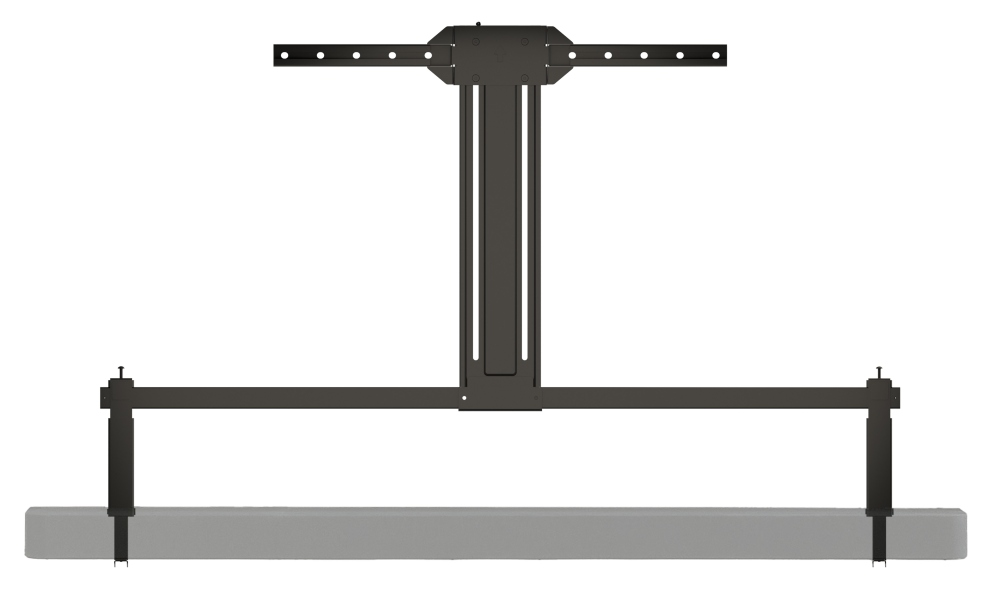

News December 9Sanus Announces Two New Mounts for BRAVIA Home Theater Systems

The new SANUS mounts for Sony BRAVIA Theater Bar 8 & 9 and Quad accommodate TVs from 50…

News December 9Lutron Report Positions Lighting and Shading as the New Design–Tech Bridge in Luxury Homes

A new report from Lutron looks at lighting and shading as the critical bridge between technology and design.

News December 9Leon, Sony Have a New Designer Frame for the BRAVIA 7

This collaboration transforms Sony’s BRAVIA 7 into a customizable gallery-style centerpiece that blends aesthetics with entertainment.

News December 8Pay-TV Subscriber Levels See First Growth Since 2017, Report Says

New bundling deals, shifting content strategies, and strong seasonal sports demand appear to be helping steady the pay-TV…

News December 8Jeff Brewer Joins Origin Acoustics as EVP, Sales

Origin Acoustics appoints Jeff Brewer EVP of Sales, adding deep CI expertise to strengthen dealer programs, expand market…

News December 8Lighting Scenes Deepen Connection to the Mountains in Custom Colorado Home

A Rocky Mountain new build becomes a case study in design-first technology, as QAV and DMF Lighting demonstrate…

Projects December 8