When the COVID-19 pandemic first hit in the spring of 2020, many residential construction projects halted. Consumers were rightfully anxious about having tradespeople inside their homes for fear of catching the deadly virus. But that anxiety was much lower about having workers doing outdoor projects. Indeed, nearly half of custom integration companies (47%) say that the coronavirus lockdown helped boost their business for installing outdoor technology either slightly or substantially.

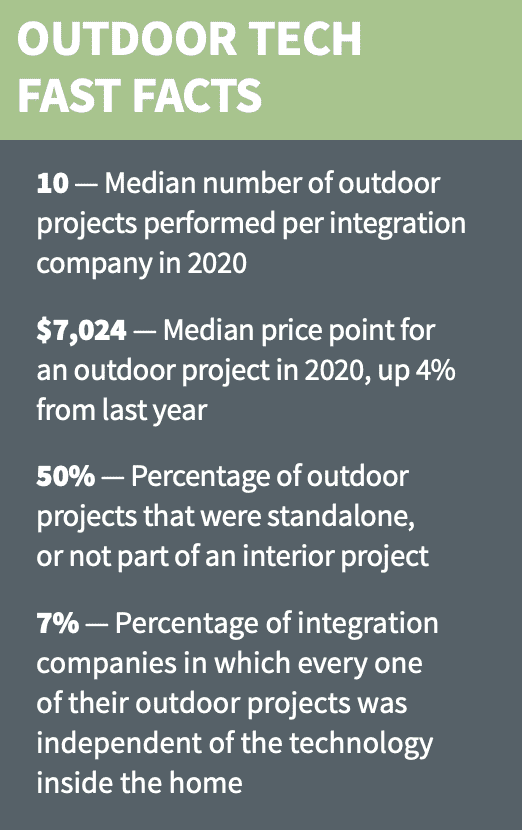

But there is an even-more-telling statistic that shows how much COVID-19 affected the outdoor market in 2020. Half of all outdoor projects were standalone jobs in which the integrator was specifically called upon to do the technology for the exterior alone. That is up substantially from 2019, when 37% of all outdoor projects were standalone.

The increase is a signal that clients were looking to expand their entertainment or living/kitchen space (or even their home office area) to the outdoors during the pandemic and were accepting of having essential workers in their yards. Finally, one more tidbit that points to the influence of the pandemic on the outdoor market. More than half of all outdoor projects in 2020 (50.3%) included the deployment of network equipment, presumably a wireless access point. Obviously, the extension of an Internet connection outdoors is not just for the purpose of having a Zoom call from the poolside or back patio, but pre-pandemic that would have been a much rarer situation.

Those are just a few interesting pieces of data gleaned from the 2021 CE Pro Outdoor Technology Deep Dive Study. The exclusive research covers a wide range of topics, including numbers of projects, price points, types of equipment being installed, predictions for 2021, most-used brands and the biggest challenges facing the market.

Average Price Inches Up; Number of Jobs Remains Stable

The average number of outdoor technology projects remained level in 2020 compared to 2019, with dealers reporting performing an average of 10 outdoor projects in 2020. As a comparative, according to the 2021 CE Pro State of the Industry Study, dealers did an average of 55 total installations (both indoor and outdoor) in 2020.

Meanwhile, the median price point for an outdoor installation rose a modest 4% in 2020 to $7,024, up slightly from $6,734 in 2019. Breaking that down a bit further, just under 10% of outdoor projects were small in scope, garnering integrators less than $1,000 for both equipment and labor. But as dealers know, outdoor projects can sometimes grow to rival large-scale indoor jobs. About 5% of all outdoor projects last year cost more than $100,000 and of those 2% of them were more than a half-million dollars.

For 2021, CE pros expect they will be able to continue to command a premium for their outdoor work and will do larger projects. More than one-third (35%) believe their average price for an outdoor job will increase this year, while nearly two-thirds expect job size and prices to remain flat. Only 2% anticipate price pressures or doing smaller outdoor jobs in 2021.

And the momentum for outdoor technology installations, from audio to video to networking to lighting, continues. A strong majority of dealers predict their outdoor business will grow this year, with 62% saying they expect to do more outdoor installations or revenues in 2021. Integrators always tend to be optimistic no matter what the circumstances are. Heading into 2020, there was an even higher percentage of integration companies (64%) anticipating more outdoor business.

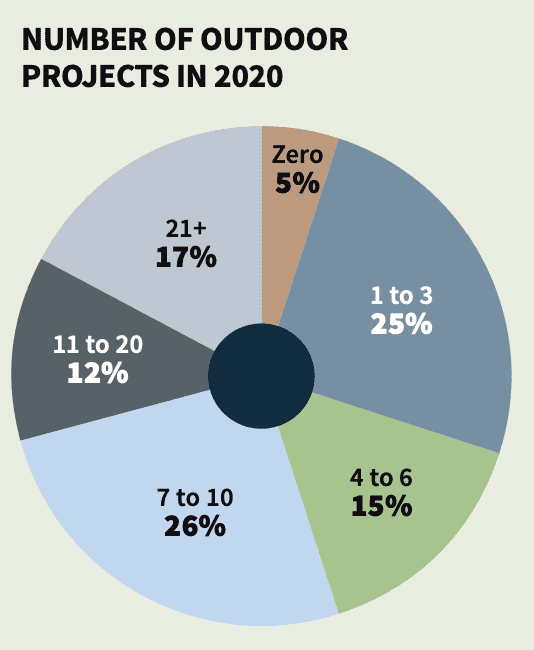

The outdoor market is not for everyone, but almost. Just 5% of integration companies reported that they did not do a single outdoor project in 2020. That is the identical percentage that reported doing no outdoor jobs in 2019. On the flip slide, 17% of dealers did 21 or more outdoor jobs last year. That is up slightly from last year’s study. The market for outdoor projects is not isolated to warm-weather climates. According to the survey, dealers across the United States, Canada and internationally are performing outdoor installations routinely.

Perhaps not surprisingly, the highest concentration of outdoor installations is among dealers located in Pacific Coast states of California, Oregon, Washington, Hawaii and Alaska. The Upper Midwest states of Indiana, Ohio, Illinois, Michigan and Wisconsin also have a strong chunk of integrators doing solid outdoor work, while the Rocky Mountain states of Colorado, Nevada, Arizona, Utah, Wyoming, Idaho, Montana and New Mexico were a stronghold for outdoor jobs as well.

Audio, Networking, Surveillance Are Most Common

The outdoor market is becoming much more wide-ranging from a technology standpoint. A decade ago, the common equipment would have strictly involved surveillance cameras and speakers and that’s about all. While audio and security are still among the top dogs when it comes to subsystems, today’s outdoor installations cover video entertainment, landscape lighting, outdoor shades/privacy/insect screens, networking and control equipment, and even smart furnishings and structures.

According to the data, nearly two out of every three outdoor jobs (65%) involve audio equipment. Within that category, obviously buried cable is the most commonly deployed element as it is for projects including buried in-ground speakers (34% of projects), followed by above-ground subwoofers (32%), 70V speakers (30%), under-eave speakers (29%) and staked satellite speakers (29%). Other types of outdoor loudspeakers being installed include rock speakers (15% of projects), planter speakers (13%) and even in-pool/underwater speakers (6%). Outdoor amplifiers are deployed in 13% of jobs, while 15% of the time dealers are installing outdoor soundbars in combination with an outdoor TV.

According to survey respondents, the top brands being used in outdoor audio are Sonance/James Loudspeaker, Coastal Source, Klipsch, JBL, Sonos, Episode/ SnapAV, Origin Acoustics/Ambisonic, Bowers & Wilkins, Bose, Jamo, Definitive Technology, TIC and Terra Speakers.

As noted, the deployment of networking equipment for backyards leapt up in the past year, with just over half of all exterior jobs (50.4%) including network-related gear such as wireless access points and/ or cell phone signal boosters. As more of us had Work from Home and/or Learn from Home situations, the need for strong connectivity became vital for outdoors just as much as indoors.

According to survey respondents, the top brands being used in outdoor networking installations are Araknis/SnapAV, Control4/ Pakedge, Luxul/Legrand, Access Networks, Ubiquiti, Cisco/Meraki, Netgear, SureCall, Wilson Electronics and Eero.

Security and video surveillance technologies remain a staple of exterior projects. A little less than half (46%) of all outdoor jobs last year included the deployment of surveillance gear. In exactly half of those surveillance installations, dealers also installed security lighting.

According to survey respondents, the top brands being used in outdoor video surveillance/ security are Luma/SnapAV, Ring, Hikvision, Elk Products, Elan/Nortek, Sony, Honeywell, Clare Controls, Leviton, Northern Video, Vivotek and GW Security.

Looking at the outdoor video category, large-format display options have certainly been given a boost in the past several years with the acquisition of SunBrite by SnapAV and the entry of Samsung into the market with its Terrace TV. According to the study, 41% of all outdoor projects last year included a video entertainment element, whether that be an outdoor TV, an enclosure or a video projector/screen.

Breaking it down further, 10% of outdoor video projects had a projector and 9% had a projection screen. That means a certain percentage of those projection-based installations simply displayed the image on a wall or some other surface. The data represents the third year in a row that the use of outdoor projection has increased. Back in 2018, it was just 3% of projects.

About 12% of outdoor TV projects included a weatherproof enclosure. Large format LED screens that you might see on-site during a golf tournament are also growing in popularity, but are still certainly a niche market.

According to survey respondents, the top brands being used in outdoor TVs, projectors, mounts and enclosures are SunBrite/SnapAV, Samsung, LG Elite, Peerless-AV, Séura, TCL, Barco, Digital Projection, Chief and Apollo.

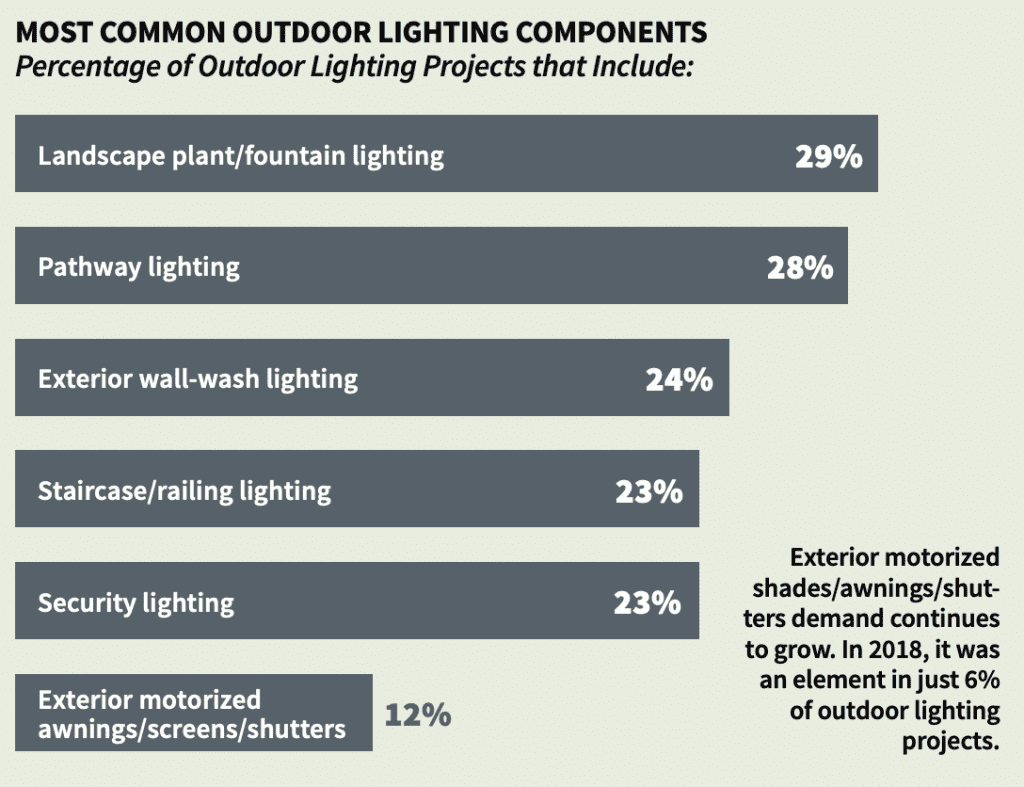

Landscape lighting is also a relatively new category for integrators but a growing one. According to the study, 32% of all outdoor projects included some form of landscape lighting. Interestingly, dealers report that clients still do not recognize that integrators can solve their landscape lighting needs. Exactly two-thirds of respondents (67%) report that clients do not ask them about exterior lighting at all. About one-third of the time, the clients want landscape lighting for aesthetic reasons, while 37% of the time it is for security purposes. Finally, most clients (71%) already have some form of exterior lighting in place before the dealer is brought on to the project.

Digging deeper, the most common application for exterior lighting is simply accent lighting for plants, trees, fountains and other features. That type of illumination was installed in 29% of outdoor lighting projects. That is an increase from 20% of lighting projects in 2019. Pathway lighting (28%), exterior wall wash lighting on structures (24%) and staircase lighting (23%) followed in terms of most common usage, and all three of those percentages represent increased amounts versus 2019.

Finally, motorized exterior awnings were installed in 12% of outdoor projects, up slightly from 9% in 2019. Unique opportunities in the category also include products like smart pergolas from StruXure, which have motorized louvres and can be controlled via Somfy motors. Likewise, insect protection/privacy screens for outdoor patios from Phantom Screens as well as awnings from Sunbrella can also be integrated via certified drivers from Somfy.

According to survey respondents, the top brands being used in outdoor lighting are Coastal Source, Kichler, Lutron, Somfy, Colorbeam, FX Luminaire, Philips, Garden Light LED, Hinkley, Lumascape, Progress, Sterno, Targetti and Profoto.

Unique Set of Challenges

The outdoor market may be strong, but there are still challenges. Dealers rue burying cable, and told CE Pro that by far the task of burying outdoor cable the most difficult element of doing outdoor work. That difficulty could be influenced by many factors, such as rocky soil, having to circumnavigate existing structures such as walkways and concrete slabs, or even frozen terrain. One integrator reported having to erect a large tent and install heaters over the area where the technicians were working at one point. Indeed, weather was listed as the second-biggest headache regarding outdoor installations.

Among the other challenges integrators indicated give them issues in outdoor projects are:

- Competing with other trades for the outdoor portion of the job, especially in landscape lighting and surveillance

- Wires being damaged and/or cut by landscapers

- Inner-city dealers whose clients have small yards, which makes containing sound difficult

- Working with multiple other trades who dealers don’t normally interact with such as landscapers, gardeners, lawn-care company, concrete contractors and pool contractors

- Educating clients regarding budget expectations, especially regarding the cost differential for outdoor-rated TVs versus indoor

- Finding exterior space to train your technicians on how to do outdoor work, especially exterior lighting design; most dealers do not have dedicated outdoor showroom spaces where technicians can develop best practices for trenching, positioning landscape lights, mitigating sun reflection, etc.

- Equipment theft

- Temperatures, both heat and cold

- Getting wireless access points to correctly hand off between each other

- Sound/loudspeaker placement

- Hiding wires

- Finding the right product.

Missing Features

As always, CE pros are not shy about expressing their desires from an equipment standpoint for outdoor technology projects.

Among the features that integrators says they would like to see are:

- All-weather speakers that can connect via Wi-Fi

- Simplified exterior amps and controls

- More powerful outdoor amplifiers

- Improved communication between the manufacturers and dealers

- Anti-theft features for outdoor speakers and TVs

- All-in-one outdoor packages that include lighting, TVs and speakers

- More outdoor wireless audio solutions to avoid needing the trench for cable

- Slimmer form factors for speakers, with network distribution using PoE+

- Improved heat displacement

- Bollard speakers with lights built-in

- IP-addressable PoE speakers

- More durable speakers

- Better water-sealing systems

- Outdoor video teleconferencing equipment

- More soundbar options

- More attractive weatherproof enclosures for TVs with improved wire routing

- Solar-powered landscaped lighting with battery storage capability for standalone independence

- Bluetooth speakers with outdoor amplification

- Easier installation and better amplification options for multiple zones

- Full range of speakers with high SPL horns

- LED lighting in speakers

- 360-degree speakers

- More robust construction of equipment for northern climates

- Motorized insect/bug screens

- Horn-loaded two-way speakers

- Improved insect-proofing

- Outdoor surround-sound options for home theater.