Residential custom integrators and the CEDIA channel continue to latch onto commercial opportunities, and the timing couldn’t be better.

The National Systems Contractors Association (NSCA) has updated its Electronic Systems Outlook report for Winter 2019, and includes information based upon actual data from January through November 2019, as well as forecasted information for 2020.

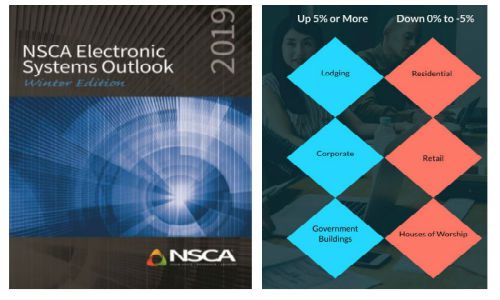

Through the lens of U.S. construction spending, the report predicts the residential integration market will be slightly down – as much as 5% – in 2020.

Unlike CEDIA, the NSCA members are predominantly commercially focused integrators, so the residential business is likely not a chief market for most. However, on the flip side the commercial sector in general has become a boon to many residential integrators. And at CEDIA Expo last year, “resimercial” and commercial business in general was a key trend among exhibitors.

In the latest State of the Industry research from CE Pro, in our January 2020 issue, it was revealed that custom low-voltage integrators earned 41.7% of revenues from commercial work – up from 32.5% in 2018 and continuing the steady upward trajectory since the recession of a decade ago.

Lodging, Corporate, Government Show Biggest Opportunities

NSCA partners with FMI on the report, which offers the newest, most relevant indicators of business opportunities for integrators. The association notes that by tracking new construction starts and renovations across multiple markets – including healthcare, lodging, retail, education, houses of worship, and more – NSCA pinpoints which verticals should do well in 2019 and beyond. Total U.S. construction spending put in place is expected to be flat, 0% growth compared to 2018.

For 2020, FMI forecasts a 1% increase in spending over 2019.

Despite the flat forecast, three markets are predicted to experience growth rates of 5% or more – lodging, corporate offices, and government buildings. These are offset by three markets that are expected to have dips of up to 5% — retail and houses of worship, along with residential.

While the majority of residential custom integrators still engage in new resi single-family construction (86% of integrators) and residential remodeling/retrofit (73%), according to CE Pro’s State of the Industry research, a good chunk are involved in non-residential new construction (44%) and non-residential remodeling/renovation (38%) to fuel such progress on the commercial side. Moreover, 3% of resi integrators said they did government projects.

The Electronic Systems Outlook Winter 2019 edition takes a detailed dive into construction data by market for electronic systems/technology, including AV, data/IT, building automation/control, life safety/fire/security, and digital signage/lighting.

Other Commercial Market Segments Appear Stable

“Construction data is a valuable indicator for the integration market. We focus on this report to provide information that will help member companies recognize where to focus their efforts,” says NSCA executive director Chuck Wilson in the ESO Winter 2019 report announcement.

“It’s promising that corporate offices are expected to experience growth of at least 5%, since a majority of NSCA member companies conduct a good deal of their business in the corporate vertical.”

Healthcare, education, and manufacturing segments are likely to grow (roughly with the rate of inflation) and be considered stable, according to NSCA.

At the NSCA’s 22nd annual Business & Leadership Conference next month in Irving, Texas, Chris Kuehl – chief economist for several organizations, and managing partner for a firm that provides forecasts and strategic guidance – will use the Electronic Systems Outlook Winter 2019 report to analyze long-term trends, current conditions, and the economic outlook for 2020 and beyond.

Integrators can also register for NSCA’s free webinar on Feb. 18 to understand more about this data and what it means for their own businesses. They can apply the report information to benchmark sales numbers and prepare business valuations, NSCA notes.

“Growth indicators can be used to determine incentive programs, reveal new market potential, and appropriately distribute resources. This forecast data can also be shared with financial advisors and lenders to prove the stability of systems integrators in the marketplace,” the association states in the announcement.