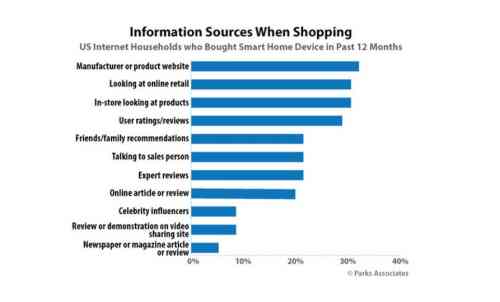

Smart home buyers research product information from an average of more than two different types of sources before making a purchase decision, and the No. 1 source for researching a smart home product is the manufacturer’s website, followed by the website of the online retailer or integrator, and then in-person shopping.

Those are the results from new smart home research by Parks Associates‘ new consumer research Smart Home Products: Mapping the Buyer Journey. The data reveals smart home shoppers collect information from a mix of online and in-store sources when researching products. The consumer study provides the latest data on smart home adoption and trends influencing consumer purchase behavior.

“Information gathering online is common, but consumers feel that experiences in the store are more powerful in the final decision to buy the product,” says Jennifer Kent, VP, Research, Parks Associates.

“The smart home shopper is clearly considering both online and in-person experiences in decisions. Dealers, technicians, providers, and contractors can leverage their expertise and close consumer interaction to establish a strong connection with the buyer and ultimately win the sale. That close connection works well for single-family home sales, and it is absolutely essential in multi-dwelling unit (MDU) projects.”

The research study reports a big leap in interest for smart appliances among households with incomes over $75,000 per year. Samsung, LG, and other leading OEMs continue to add more features to their smart appliances, hoping to capitalize on the recent boom in home renovations, but many lower-income households are also interested in smart appliances so there is an opportunity in a basic value model.

In addition, the study contains new research on consumer adoption and usage of various connected solutions:

- More than half of internet households have a smart speaker.

- 15% of internet households own a smart video doorbell.

- Security system apps continue to be the most common tool for controlling multiple smart home products.

“As consumers grapple with inflation, rising energy costs, and a shortage of essential items, smart home players need to meet consumers where they are to maintain growth,” Kent said. “Consumers expect access to information, different price points to choose from and options for delivery and installation.”