A new global study confirms what Google and others have already determined… that professional service will be a driving factor for the smart home market going forward.

The Global Smart Home Services study from Grand View Research pinpoints that the “service” of smart home equipment provided by custom integrators is vital to further growth of the home automation market, which could being hindered in the future by the need for repair and maintenance of devices. The study goes on to note that the solution is for integrators to offer “end-to-end repair and services.”

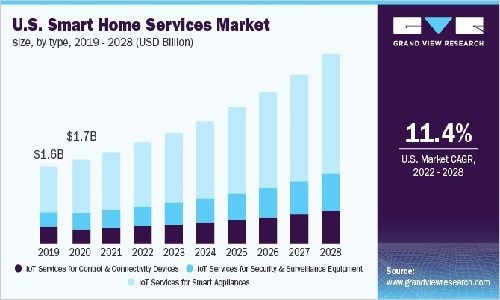

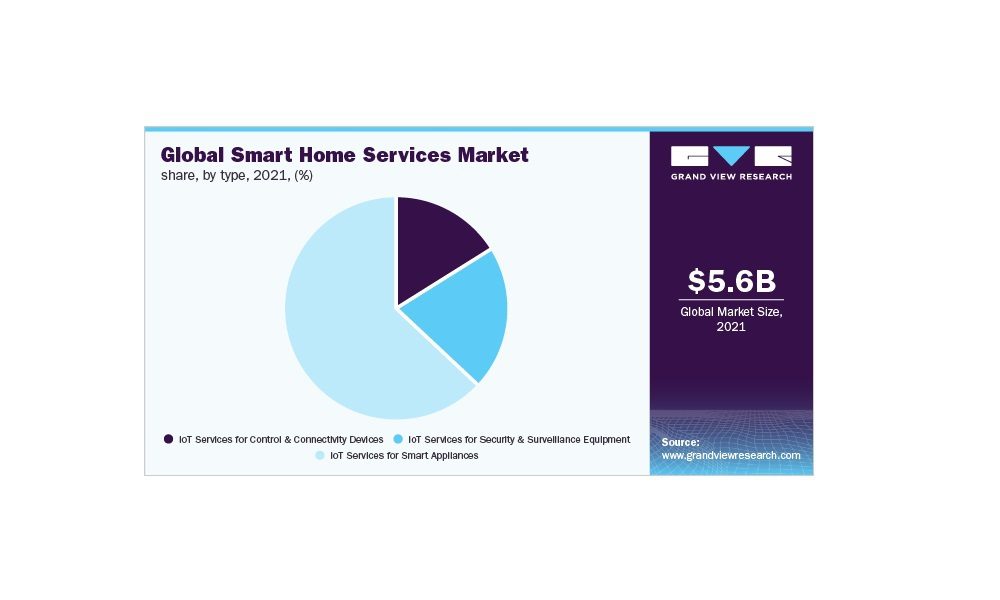

The research gauges the worldwide smart home services market size at $5.6 billion last year (2021) and expects the market to expand at a compound annual growth rate (CAGR) of 11.2% from 2022 to 2028.

“The increasing adoption of cognitive systems in smart homes is increasing demand for installation and maintenance services thereby driving the expansion in the industry. Moreover, the growing demand for the preference of energy management solutions is expected to propel the market size,” says the study.

The report says COVID-19 outbreak “positively impacted the business growth over time,” noting, “the smart home services market has witnessed a considerable surge due to the introduction of various new features among smart home devices, which has increased the installation and maintenance services during the COVID-19 pandemic.”

According to the study, the IoT services for Smart Appliances segment will represent 60% of the market demand, with an annual growth rate of 11.5% through 2028.

Smart home services for Security & Surveillance equipment is the next biggest opportunity, with an anticipated growth rate of 10.8% per year for the next six years.

“IoT services for Security & Surveillance equipment require ongoing maintenance after setup and installation to ensure their operating.

“The modern technology in Security & Surveillance equipment requires recurring updates for underlying software and smooth running. The maintenance includes security patches, tamper detection, firmware updates and camera downtime alerts which needs to be solved after couple of months. Thus, the IoT services for Security & Surveillance equipment segment is expected to expand at a steady CAGR in the forecast period,” says the study.

The confirms that integrators should be looking to offer ongoing service agreements to clients that earn recurring monthly revenue (RMR).