New Data from D-Tools’ new Payments solution suggests that integrators are diversifying their payment methods, with ACH and credit card payments now the most preferred payment methods as the industry evolves to meet client expectations.

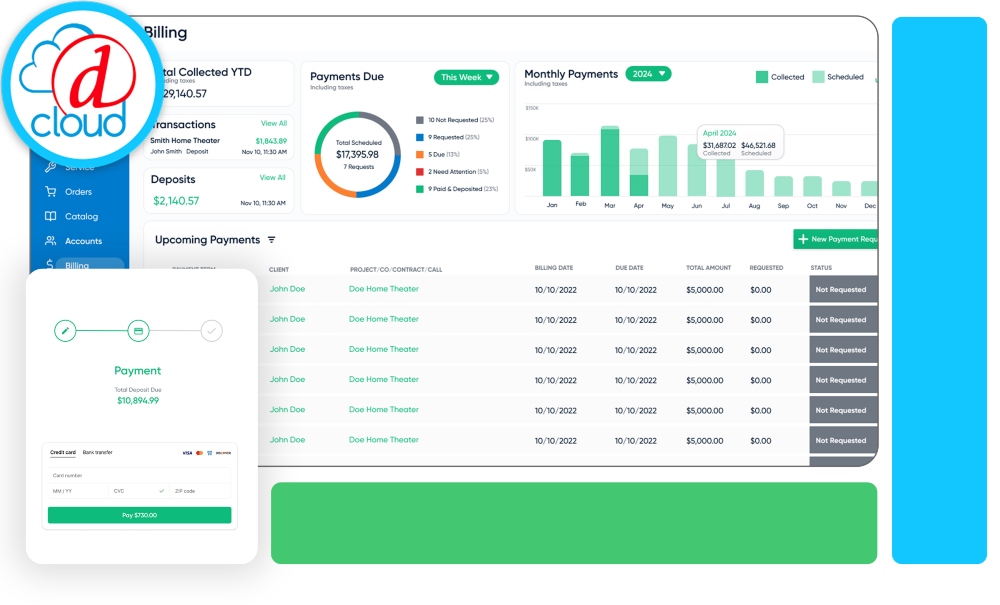

The data is drawn from the first few months of the implementation of D-Tools Payments, the integrator-focused software company’s embedded payments solution in D-Tools Cloud. Like other industries and sectors, the integration industry has evolved past only taking cash and checks, with most integrations recognizing the need to take payments by credit cards, wire transfers and ACH payments.

Integrators Largely Prefer ACH over Credit Card Payments

According to D-Tools’ report, The Evolution of Payment Processing, 61% of integrators say ACH is their preferred payment method. Meanwhile, 15% say they prefer credit cards, and 12% said they have no preferred payment method.

It appears that ACH payments are quite higher than credit card payments, with the average ACH payment received more than $6,700 compared to the average credit card payment of nearly $2,500. ACH payments may be preferred due to their low cost, security and suitability for recurring payments. However, these payments can take up to three days to be approved and up to five days to reach an integrator’s bank account.

D-Tools’ report also found that 51% of electronic payments were processed for deposits, 27% of electronic transaction receipts are processed for progress payments, and service contracts represent 22% of electronic transactions receipts.

According to the company’s data, credit card processing fees can be upwards of 4%, while the maximum charged for ACH transactions is just $10, again suggesting that ACH payments are a much cheaper option.

The company lists the pros and cons of each payment method, with credit cards being good for convenience and quickness while having higher fees, lower transaction limits and a higher risk of fraud.

Meanwhile, ACH payments have lower fees, better security, and no transaction amount limits. However, they process much slower and are generally less convenient for customers.

Can Integrators Counter Credit Card Processing Fees?

Within the report, Adam Holden, head of payments at D-Tools, says integrators may be able to add a surcharge if the customer plans to pay by credit card or ACH.

“You can’t just say, “Oh, you are paying by credit card. I am going to add 3% to your bill. That is highly, highly illegal, and it is definitely not compliant,” says Holden, who has years of experience in the automatic payments industry.

“Its going to differ from state to state and there are rules established by Visa, MasterCard, Discover, American Express that are sometimes hard to nail down. If you are an integrator adding surcharges for these forms of payment, it has to be on point otherwise there could be ramifications.”

Instead, integrators should have their payment processing system do the calculations automatically with the proper, legally approved verbiage in their contracts. Language stating there is a cash discount available is often the solution versus trying to implement a surcharge, Holden adds.