The Latest

Filter by Topic

Filter by Type

The Week in Playback: Recapping ISE 2026

CE Pro looks through all the news static throughout the week to find the stories and discussions affecting…

News February 8What Caught Our Eye at ISE 2026

CE Pro breaks down the standout products and ideas that defined ISE 2026, from luxury control and lighting…

News February 6Nice to Exhibit at FENCETECH 2026

While at the show, Nice will be highlighting its complete, end-to-end gate and access control portfolio, bringing together…

Briefs February 6ARCAM’s Latest Radia Series Models to Feature Dirac Live ART

The ARCAM Radia AVA15, AVA25, AVA35 and AVP45 will be available beginning in Q3 2026, with Dirac Live…

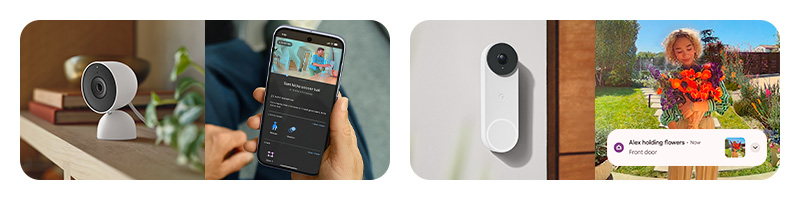

Briefs February 6Google Home Premium with Gemini. Helping You Bring More Value to Every Install.

The future of the smart home is here. And it’s built with Gemini, Google’s most capable AI.1 With one…

Sponsored February 6Custom Wooden Panels with Inlaid Theater Lighting Crown Prosper Media Room

Theater Advice creates a striking, yet simple, home theater with a unique ceiling lighting system built mostly from…

Projects February 6Draper At Home Elevate Cordless Shades

Draper At Home introduces the Elevate collection of cordless, automated shades. Elevate shades offer a child-safe alternative to…

Products February 5ASSA ABLOY Completes Sargent & Greenleaf Integration into Portfolio

Sargent & Greenleaf (S&G) is now officially incorporated into the ASSA ABLOY Group portfolio, the company reports.

Briefs February 5Silicon Labs to be Acquired by Texas Instruments

A press release put out by Texas Instruments says the union aims to leverage operational synergies to greatly…

News February 5